Understanding the Real Impact of Inflation and How to Protect Your Wealth

In early December 2021, the Bureau of Labor Statistics (BLS) announced that the Consumer Price Index (CPI-U) rose 0.8% in November from October. This is an annualized increase of 9.6%. Over the last 12 months, inflation has risen 6.8%—the largest 12-month increase since 1982.

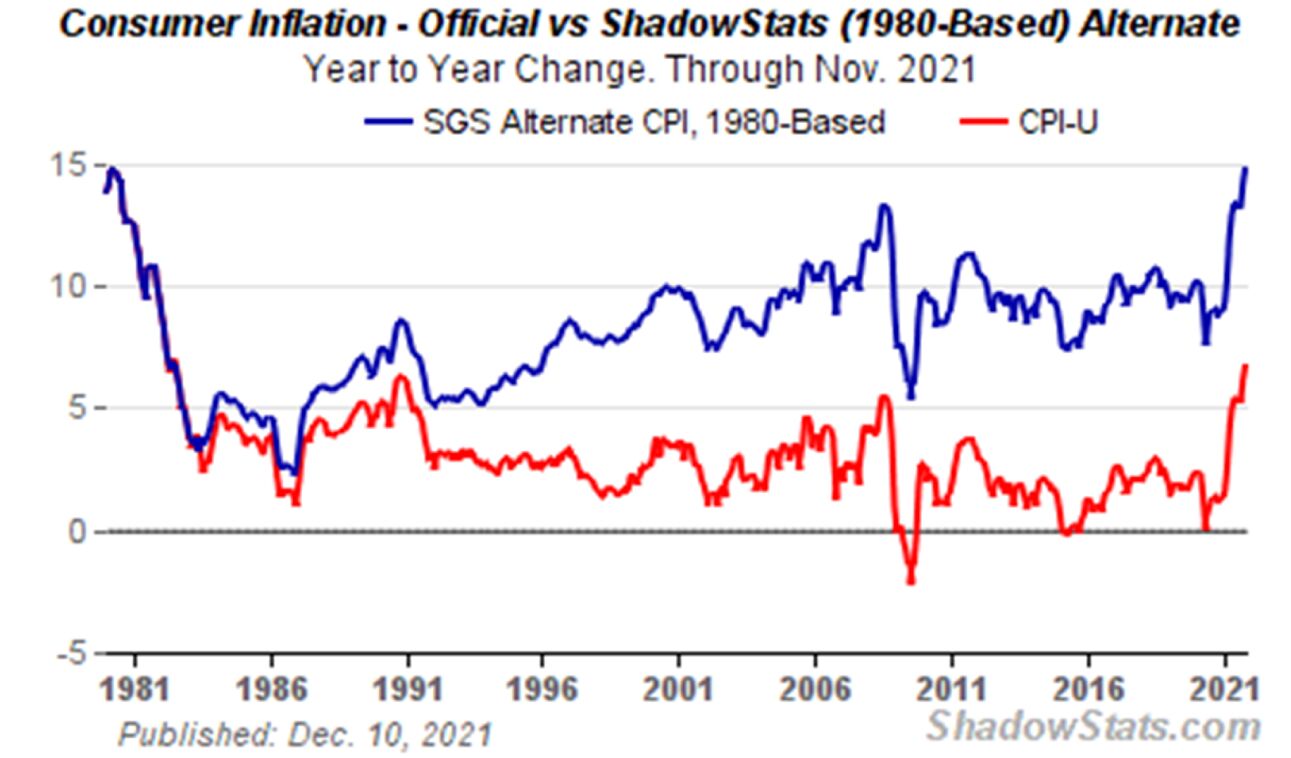

Those are the official numbers. But, if inflation were measured like in 1980, the CPI would show an annualized rate of about 15%. Here’s a chart that, in our view, provides a more accurate picture of inflation, courtesy of John Williams’ ShadowStats service.

The Shift in How Inflation is Measured

In the real world, inflation would be tracked by measuring the cost of buying a fixed basket of goods and services, roughly approximating the cost of maintaining a constant standard of living. Indeed, from the 1700s until around 1980, that’s how inflation was measured.

Free Wealth Protection Insights

Enter your email below to receive our weekly briefings on better ways to preserve your wealth, legally reduce your tax bill, and better protect what you’ve worked hard to build.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

PLEASE NOTE: This e-series will be delivered to you via email. You should receive your first message minutes after joining us. By signing up for this course, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

But beginning in the 1980s and accelerating through the 1990s, the BLS converted the CPI away from measuring the price changes in the fixed basket to changes in a basket where consumers could substitute lower-priced goods and services if higher-priced ones became too expensive. The theory was, in former Fed Chairman Alan Greenspan’s words, “you’ll switch to something cheaper—more hamburger will show up in your meals than steak.””

Hedonic Adjustments: Underestimating the Cost of Living

The BLS also introduced a concept called “hedonic adjustment.” This theory holds that as the quality of goods or services improve, their effective cost decreases, even if consumers have no opportunity to buy those goods or services at a lower price.

In other words, hedonic adjustments are criticized for underestimating the actual cost of living by assuming quality improvements outweigh price increases. Thus, according to the official CPI, a television that cost $1,000 in 1996 should now cost $22.

But when was the last time you saw a working television of any age you could actually buy for $22?

The Real Price Increase: A Closer Look

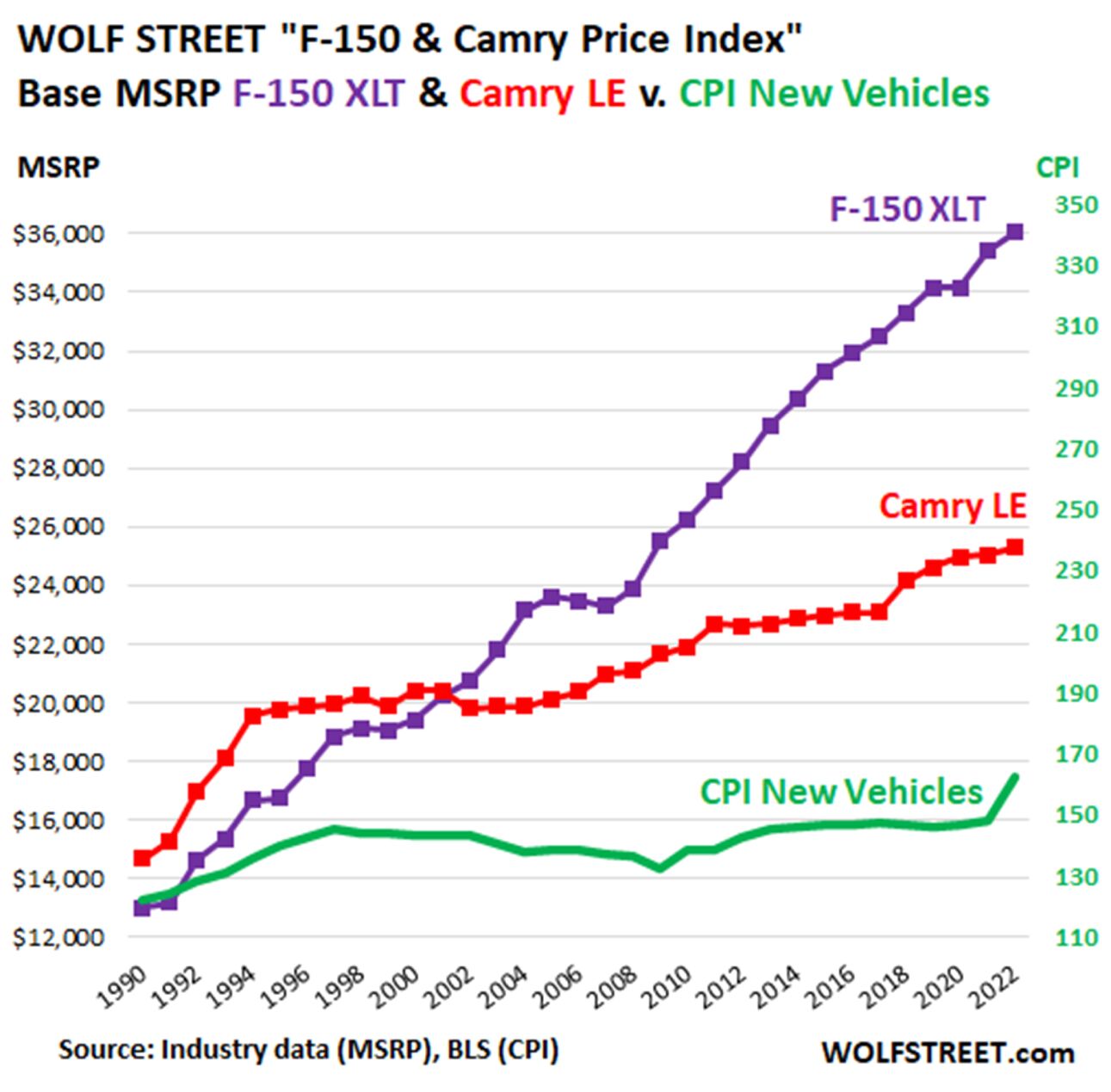

Another analyst we follow, Wolf Richter, offers the following chart. It tracks the actual prices of a Ford F-150 pickup truck and a Toyota Camry LE car versus the hedonically adjusted CPI for new vehicles. The result, to put it mildly, is eye-opening.

Is Inflation Really Transitory?

In early November 2021, mainstream economists and the Federal Reserve were proclaiming this inflation wave would be transitory. The Biden administration still says inflation will be transitory, blaming supply chain disruptions caused by the COVID pandemic. Meanwhile, Senate Democrat Elizabeth Warren blames inflation on “greedy corporations.”

Surprisingly, we think both President Biden and Senator Warren are partly right. But, for different reasons than you might think.

But over the next year, inflation won’t feel transitory. Our conclusion stems from the fact that producer prices are rising at an even faster pace—11.8% to 27.8% annually, depending on how close products in the supply chain are to being offered to consumers. And again, these are hedonically adjusted prices.

Who’s Really to Blame for Inflation?

That brings us back to Senator Warren’s statement that greedy corporations are responsible for inflation. They are, but so is everyone else. The reason is that there is a huge psychological component to inflation. One predictable result is hoarding. People are buying more “stuff” than they need today because they anticipate price increases tomorrow.

And businesses are happy to oblige. That’s why Proctor & Gamble was able to increase prices on baby products, adult diapers, and feminine-care brands last September. Consumers are now conditioned to pay more. Thus, we can just as easily blame consumers for inflation because they’re willing to shell out more money for the products and services they need.

Who Are the Primary Drivers of Inflation?

What’s more, you could justifiably conclude that greedy workers are the cause of inflation. As the US economy reopens after 2020’s COVID-related lockdowns, employers are facing an unprecedented shortage of available workers. And workers are taking advantage by leaving their current jobs in record numbers to nab higher-paying ones.

But in fact, neither businesses, consumers, nor workers are the primary drivers of inflation.

Economists define inflation as an increase in the money supply. There are various ways of defining the money supply, some of them mind-bendingly technical. But a working definition for our purpose comes from the Mises Institute:

Cash + demand deposits with commercial banks and thrift institutions + government deposits with banks and the central bank.

Thus, when the Federal Reserve creates trillions of dollars out of thin air and uses it to buy Treasury securities that it then places on its balance sheet. That action represents an increase in the money supply. So do the various bailout packages enacted by Congress over the last two years that have sent thousands of dollars to all but the wealthiest Americans.

An increase in the money supply results in more dollars being spent on stocks, goods, services, or whatever. And that sets price hikes in motion. The fact that politicians like Senator Warren ignore this reality doesn’t change the causal relationship between inflation and the money supply.

The Destructive Power of Inflation

Inflation is, without a doubt, the most destructive economic malady that can befall a nation. Each year, the real value of the cash in your bank account is worth about 15% less than it was the year before. Every American must increase their income by 15% annually or generate a consistent 15% or higher return on their savings just to keep up.

And that’s before taxes—if you pay 40% of your income in taxes, the breakeven number jumps to more than 23% annually. No conventional investment can consistently offer such returns. And no business can afford to raise its prices 23% annually and hope to keep its customers.

It’s a vicious cycle. But as President Biden has predicted, inflation is transitory. Eventually, we’ll reach a tipping point where inflation leads to an economic collapse not unlike what Germany experienced in the 1920s. And as we know, that in turn led to the Great Depression—an enormous and extended deflationary period.

How to Protect Your Wealth

There are no easy answers to the inflation dilemma. We remain advocates of gold and stockpiling real goods in the expectation that prices will rise in the months and years ahead.

We’re also still fans of the Permanent Portfolio strategy, devised by our colleague, the late Harry Browne, more than 50 years ago. This investment strategy is designed to protect against all economic conditions, including inflation.

Need Help?

Since 1984, we’ve helped more than 15,000 customers and clients protect their wealth using proven, low-risk domestic and offshore planning. To see if our planning is right for you, please book in an introductory consultation with one of our Associates. You can do that here.