Residency in Panama: Should it Be Part of Your Plan B?

-

Written by The Nestmann Group

- Reviewed by Brandon Roe

-

Updated: July 29, 2025

Contents

- Why (or Why Not) Panama?

- #1: The Dollar Advantage

- #2: Geographic Sweet Spot

- #3: Infrastructure That Works

- #4: The Territorial Tax System

- #5: English-Friendly Environment

- #6: Property Rights and Legal Framework

- Who Thrives in Panama?

- Who Should Look Elsewhere

- Your Panama Residency Options

- #1: Pensionado(Retiree) Visa

- #2: The Friendly Nations Visa

- #3: The Qualified Investor Visa

- The Real Panama Residency Process (What Actually Happens)

- Paperwork Prep (Document Deadline Juggling)

- The Application Journey

- Common Myths and Mistakes

- A Practical Path to International Freedom

- Sources

America’s wealthy are voting with their feet.

According to one study, inquiries from America’s wealthy about residency and citizenship abroad increased by 183% in Q1 2025, compared with Q1 2024.

Free Wealth Protection Insights

Enter your email below to receive our weekly briefings on better ways to preserve your wealth, legally reduce your tax bill, and better protect what you’ve worked hard to build.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

PLEASE NOTE: This e-series will be delivered to you via email. You should receive your first message minutes after joining us. By signing up for this course, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

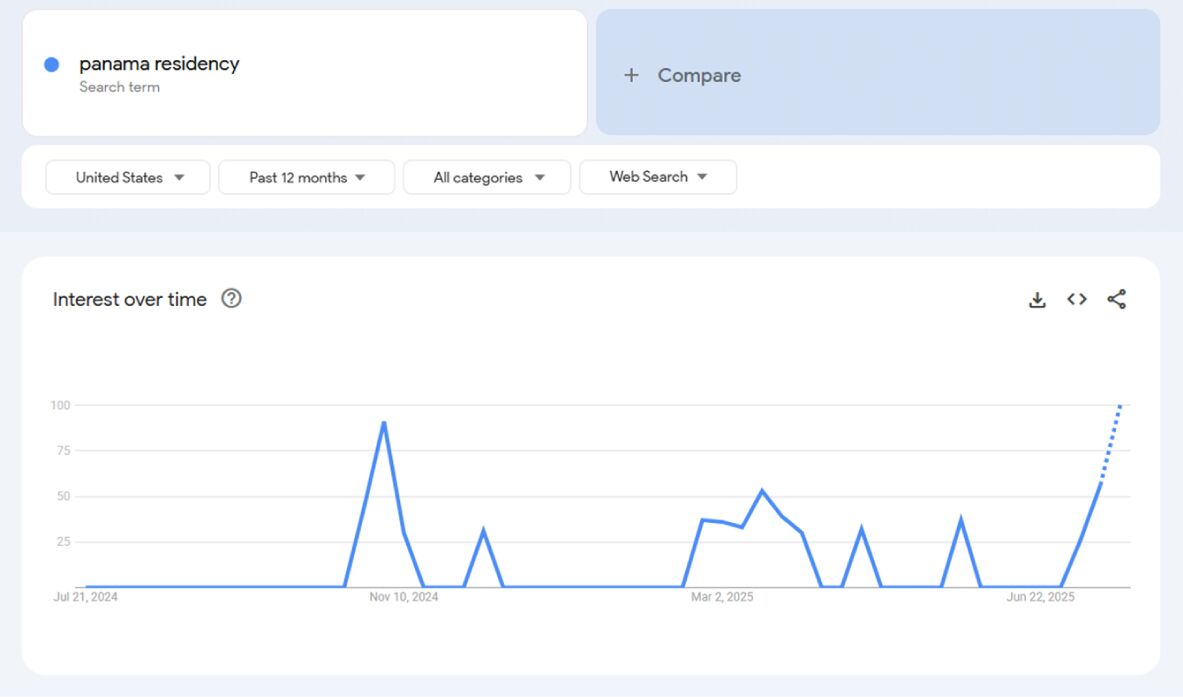

Google search data tells the same story. Americans aren’t just thinking about Panama residency options – they’re actively looking for them: Google search volume for the term “panama residency” has significantly spiked several times since March 2025, when Trump’s tariff threats were starting to gain considerable momentum.

Note: 0 = lower relative searches; 100 = very high relative searches. Source: Google Trends

Panama stands out from the crowd. It runs on the US dollar. It’s three hours from Miami. It has advanced medical care in its capital. And it doesn’t require you to spend half the year there to maintain your residency. (Unlike many other places.)

But, like most programs, it pays to have someone guiding you through the process. Second residency in general – and the Panamanian program specifically – can be tricky to navigate.

That’s why, in this piece, we’ll show you the real Panama residency landscape. The options that actually work, the timelines you can expect, and the most common mistakes that derail applications.

And most importantly, we’ll explain why professional guidance is essential, not optional.

Jump to: Your Panama Residency Options

Why (or Why Not) Panama?

#1: The Dollar Advantage

At the moment, we have a lot of clients trying to diversify out of the US dollar and into other currencies. But, as part of a comprehensive plan, there’s also something to be said about the ease of sticking with something you know.

That’s one benefit of Panama.

#2: Geographic Sweet Spot

Panama City is just a three-hour flight from Miami. It’s easy to get to from many places in the US, including New York, Orlando, Houston, and Dallas/Fort Worth.

#3: Infrastructure That Works

Hospital Punta Pacífica in Panama City – affiliated with Johns Hopkins – offers care comparable to the US, at half the cost. And that’s just one of a handful of top-tier hospitals in the country.

Internet within Panama’s cities is stable and reliable, though internet outside of those major metros may be spotty. And while the nation’s banking can test your patience, especially as a non-resident, it does work – with the right setup and introductions.

#4: The Territorial Tax System

Panama only taxes income earned within its borders. That’s often touted as a major benefit for the online gurus and expat YouTubers of the world – and it is… if you’re not American.

Americans, however, are taxed on citizenship. (With one exception, the rest of the world either taxes by residency or, like Panama, as a territorial tax system.)

That means the IRS expects you to pay even as if you never left, no matter how long you spend out of country.

That said, there are certain benefits that can come if you make Panama your main place of living. But it needs solid planning and good knowledge of the rules.

#5: English-Friendly Environment

In Panama City, you’ll find many professionals – doctors, bankers, lawyers – speak English. You can get things done without a phrasebook.

But the moment you step outside the capital or tourist zones, Spanish becomes essential. That doesn’t mean perfection – but conversational Spanish will go a long way in building relationships and avoiding frustration.

#6: Property Rights and Legal Framework

Panama’s constitution guarantees private property rights, and foreigners can own land outright – including ocean-view homes and farmland.

But here’s where it gets tricky: if you hold property in your personal name, your heirs could face years of probate delays. That’s why we almost always recommend using a Private Interest Foundation (PIF) or properly structured company to hold real estate long-term.

Read more: Panama Private Interest Foundations (PIF) for Real Estate: A Guide for American Owners

Read more: Buying Property in Panama

Ready to Buy in Panama — Without Mistakes?

If you’re actively planning a purchase — or want to avoid costly mistakes — you need to go deeper. Our full Panama Property Report, part of the Nestmann Inner Circle, covers:

-

How to structure ownership to protect assets and maintain privacy.

-

Hidden tax traps most buyers miss.

-

Real case studies from our clients.

Who Thrives in Panama?

-

Retirees with $1,000+ in reliable monthly pension income.

-

Professionals who can work from anywhere.

-

Investors seeking dollar-based real estate and business opportunities that aren’t directly tied to the US economy or political situation.

-

Those building a Latin American base but don’t want to give up first world amenities.

-

Anyone comfortable navigating cultural differences – or learning Spanish.

Who Should Look Elsewhere

-

Americans expecting “the US with palm trees.” Panama is a proud Latin American country.

-

Those unwilling to learn basic Spanish outside the expat bubble.

-

Perfectionists who struggle with “mañana” time (a much slower pace of life) and bureaucratic loops.

-

Clients who prefer American-style infrastructure in every aspect.

-

Anyone who finds tropical humidity a dealbreaker. (With the exception of the western highland towns like Boquete or David, which are perfectly pleasant.)

Your Panama Residency Options

Panama’s residency landscape changed in 2021. Programs that once required little more than paperwork and a few thousand dollars now demand a real financial commitment.

But for Americans, a few practical paths remain open – especially if you plan ahead and work with the right team.

#1: Pensionado (Retiree) Visa

If you receive a guaranteed monthly pension – for life – you may qualify for one of the most generous retirement residency programs in the Americas. It’s also very common among our clients.

To qualify, you need:

-

A lifetime pension of at least $1,000/month (Social Security counts).

-

Add $250/month per dependent (e.g., spouse).

-

OR reduce the pension requirement to $750/month if you buy Panama real estate worth $100,000 or more.

Processing time: About 3 to 6 months.

What you get:

-

Immediate permanent residency after a 3 to 6-month processing time (no temporary phase).

-

Big savings on daily costs:

-

25% off electricity, phone, and water bills.

-

30% off public transport.

-

20% off doctor’s visits.

-

15% off hospital services (if no insurance applies).

-

50% off movie, cultural event, and sporting event tickets.

-

-

An import tax exemption on household goods.

-

And an import tax exemption on a new car every two years (though you’ll still have to pay other applicable taxes).

What it does not allow:

-

You cannot work for a Panamanian company under this visa.

-

Income must come from pension or annuity sources only – not active business earnings.

For many Americans, the Pensionado visa offers real lifestyle value. But remember:

- The pension income must be documented properly.

- US-issued documents need to be apostilled, translated, and submitted quickly before they expire.

- And while the visa may be straightforward, the paperwork isn’t. Simple mistakes can delay the process by months.

Case in point: A client of ours applied for residency under this program prior to working with us on a foreign investment strategy. The immigration office made a one-letter mistake in his name. It took six months to clear up.

That’s why we work closely with our trusted Panamanian attorneys to ensure every step – from your Social Security letter to your immigration timeline – is managed correctly from the very beginning.

#2: The Friendly Nations Visa

This residency program still works, but the “$5,000 in a bank account” version is long gone. Now, you need to make a real investment or prove you’re contributing to the local economy, and processing time takes about 2 to 3 months now to get your temporary approval.

There are three updated paths to qualify:

Option 1: Employment-Based Residency

The least common path, but still an option.

- Requires a job offer from a Panamanian company.

- The employer must prove they need foreign talent or expertise.

- Comes with a work permit (must be processed separately).

- Starts with a 2-year temporary residency. After that, you can apply for permanent status.

This path is more useful for those already in Panama or working in a niche field. It’s rarely the best route for US retirees or business owners.

Option 2: Real Estate Investment Residency

The most popular path under the revised rules.

- Buy real estate worth at least $200,000.

- The property must be titled in an individual’s name or a relevant “alter-ego” structure and lien-free.

- Pre-construction units don’t count – the title must be ready at the time of application.

- Like the other options: 2-year temporary residency, then permanent.

This option is ideal for Americans who already plan to own property in Panama. But the structure matters. Owning real estate in your personal name has its uses, but it lacks the probate prevention that professional structures can provide.

Option 3: Bank Deposit Residency

The more passive path for those who like things simple.

- Deposit $200,000 into a Panamanian bank, fixed-term.

- The funds must stay in place for the full 2-year residency period.

- You’ll need to prove the funds came from outside Panama (for anti-money laundering compliance).

- After 2 years of temporary residency, you can apply for permanent status.

Power of Attorney submission is also allowed under the Friendly Nations Visa.

How Our Founder Got His Panama Residency

Mark Nestmann, our founder, obtained Panama residency more than a decade ago – back when the Friendly Nations Visa was simpler and faster.

At the time, the requirements were straightforward:

Form a Panamanian company (about $1,200).

Deposit $5,000 into a local bank account.

He made two short trips to Panama. On the first, he submitted his application at the immigration office. A paralegal accompanied him to interpret, and a staff attorney translated during the bank meeting.

Approval came quickly – but the bank account took months to open. Once the account was set up, he returned to Panama, visited immigration again, and walked out with his permanent residency card. The total cost, excluding travel and banking, was around $3,500.

Then came COVID. Panama requires residents to visit at least once every two years to maintain status. Mark hadn’t visited since 2018. But in 2021, the government launched a program allowing people like him to regain residency with a simple reactivation process. Our preferred lawyer there handled the entire thing, and Mark still holds his permanent status today.

The key point?

The Friendly Nations Visa isn’t what it used to be. Today, it requires a six-figure investment, starts with temporary residency, and is usually best for clients that don’t qualify for a Pensionado and/or want the flexibility to work in country.

#3: The Qualified Investor Visa

If you’re looking for a route to Panama residency that has one of the faster processing times (usually about 30 days) and you have the money to invest, the Qualified Investor Visa might be your best option.

Two Ways That Americans Can Qualify:

1) Real Estate Investment

- Minimum $300,000 in titled or pre-construction property. (Note: The pre-construction option is an advantage that the Qualified Investor Visa has over its Friendly Nations counterpart. But if you’re investing in pre-construction, you’ll need a notarized and authenticated promissory contract, which is basically an agreement you’ll sign promising to buy the property in the future).

- Property can be residential or commercial.

2) Bank Deposit

- $750,000 fixed-term deposit at a Panamanian bank.

- Must be held for at least 5 years.

- Funds must come from outside Panama and be properly documented.

Benefits:

- Permanent residency in about 30 days.

- Similar to the Friendly Nations Visa, no in-person visit required to apply – you can use a Power of Attorney.

- Include your spouse, children under 25, and even your parents.

- Flexible exit: after five years, you can sell or withdraw the investment.

Ongoing Requirements:

- You must hold the investment for a minimum of 5 years.

- You’ll need to prove the funds originated abroad.

- You must visit Panama at least once every two years to keep residency active.

- Annual proof of your investment’s validity is required to maintain status.

Here’s What We Show Clients Looking to Buy Real Estate in Panama

Panama offers permanent residency through real estate investment – without forcing you to abandon your US life.

But to leverage this triple opportunity – and avoid costly missteps – you need to understand how Panama’s property laws, residency programs, and territorial tax system actually work. Not just what the brochures say.

Our full Panama Real Estate Report, available through the Nestmann Inner Circle, covers the essentials of what we show our clients in private engagements, including:

-

How to qualify for permanent residency with just $300,000 in real estate (before the threshold jumps to $500,000).

-

What due diligence actually protects your investment (and what gets Americans into trouble).

-

Why Panama foundations shield your assets better than US structures – and how our clients use them.

The Real Panama Residency Process (What Actually Happens)

Getting Panama residency sounds simple until you hit the paperwork.

Let’s walk through what really happens behind the scenes.

Paperwork Prep (Document Deadline Juggling)

Every residency path starts the same way: with documents from your home country. Like many countries, Panama has strict rules on how those documents are prepared and submitted. The right professional guidance is key to avoiding preventable application delays and rejections.

Criminal Background Checks

-

Police certification required from your home country. (In the US, that’s the FBI.)

-

Some applicants need state-level reports, too, although this is less common.

-

Only valid for 6 months.

-

Must be apostilled by the US State Department, not just notarized.

-

Then translated into Spanish by a certified Panamanian translator.

Financial Documents

-

Bank statements? They need apostilles too.

-

Pension letters must clearly state the income is for life. (Informed readers will know that Social Security does not offer any written documentation to confirm that this income is for life. There is a way to address this.)

-

Investment documents must include proof of source of funds – where the money came from, not just where it’s sitting now.

Client Case Study

Getting a Pensionado Visa

Background: Over the years, we’ve helped multiple clients obtain Panama’s Pensionado visa—one of the most accessible long-term residency options in Latin America. It’s specifically designed for retirees, offering generous incentives.

Problem: An American couple approached us with a pension income of $2,200/month and wanted to relocate to Panama within six months. They had previously tried to get the visa through a local law firm they found online, but communication broke down quickly due to delays, conflicting requirements, and little guidance on US document prep.

They were also unaware that US-issued documents had to be apostilled, translated, and submitted within a tight validity window, resulting in expired paperwork by the time they were ready to file.

They wasted six months, several thousand dollars in legal fees, and had to restart the process.

Solution: In most cases, we follow the lead of the Panama attorney. Our role focuses on the US side of document preparation – making sure clients get their Social Security letters and background checks apostilled, translated, and submitted correctly.

We also coordinate with the Panamanian attorney to make the timelines work, avoid having to do things repeatedly, and plan around any compliance or tax-related issues. This keeps the process efficient and reduces the risk of costly delays.

Lesson: Panama’s Pensionado program can be straightforward on paper – but the team around you can make or break the experience.

More importantly, the visa is just one step. Moving overseas involves more than immigration paperwork. Property ownership, local banking, healthcare access, tax strategy, and estate planning all need to be factored into a coherent strategy.

If you’re a US retiree considering Panama, don’t assume a visa equals a complete plan. A successful international move means coordination across multiple fronts.

The Application Journey

Once your documents are ready, here’s what actually happens from submission to approval and beyond.

This part is less about paperwork and more about timing, coordination, and following the process exactly as required.

Step #1: Submitting the Application

Your Panama attorney files your application with immigration. This is not optional. Using a Panamanian lawyer is required by law.

- You’ll sign a Power of Attorney giving your attorney permission to act on your behalf.

- If you’re applying from abroad, they can usually submit everything before you arrive.

Step #2: The Waiting Period

Processing times vary depending on which residency path you take:

- Pensionado Visa: Typically 3–6 months.

- Friendly Nations Visa: About 2–3 months to get temporary approval.

- Qualified Investor Visa: Around 30 days.

Step #3: Approval and In-Country Steps

Once your application is approved, you’ll need to travel to Panama to finish the process.

- You must enter Panama within a specific timeframe to activate your residency.

- Attend a biometrics appointment (fingerprints and photos) at immigration.

- Receive your temporary residency card (called a cédula).

- In some cases, you’ll return later to receive your permanent cédula.

Step #4: Maintaining Your Status

Getting residency is just the start. You’ll need to keep it active:

- Visit Panama at least once every two years or risk losing your status.

- If you used the Qualified Investor Visa, you must keep your investment active for 5 years.

- For Pensionado residents, continue receiving your lifetime pension income.

- Report any changes in your family, income, or status to immigration.

Residency is a legal status, not a set-it-and-forget-it solution. That’s why residency belongs in a larger Plan B strategy.

Client Case Study

The Stateless Cautionary Tale

A client once applied for a Panamanian travel passport (an old residency program that’s no official sources say still exist), mistakenly believing it was the same as citizenship. Thinking he was now a Panamanian citizen, he renounced his US citizenship.

Later, when he tried to renew his Panama residency, immigration officials asked for proof of US citizenship. He had none. The passport he had was based on residency, not full citizenship.

The result? He was stateless for a time – without legal status in any country.

With our help, he was eventually able to secure Dominican citizenship and resolve the issue. But it was a huge hassle and could have been permanent if he hadn’t had the money to pay for the Dominican Citizenship by Investment program.

Remember: Residency is not the same as citizenship. If you make decisions based on the wrong assumption, the consequences can be severe.

Common Myths and Mistakes

Myth #1: "I Can Get a Panama Passport Quickly"

Reality: Residency is not citizenship, and there’s Panama does not have a Citizenship by Investment program. If you are interested in citizenship, you must live in Panama for at least 5 years before you can apply, and go through a valid program that offers a path to citizenship (not all residency programs do). Also keep in mind that Panama doesn’t officially recognize dual citizenship, which can be a problem.

Myth #2: "The Friendly Nations Visa Is Still Cheap"

Reality: The $5,000 deposit route is gone. Today, you need a $200,000 real estate investment or a job with a Panamanian company.

Myth #3: "I Don't Need Spanish"

Reality: You can get by in Panama City with just English. But Panamanian citizenship requires fluency, including a written test and an interview. If that’s your goal, start now.

Myth #4: "Panama Banking Is Like Switzerland"

Reality: Panama has decent regional banks. But opening and maintaining an account isn’t easy. Everything’s in Spanish. Most Panama banks won’t even talk to you without a valid residency permit or other connection. And Swiss banks are much better capitalized.

Myth #5: "I Can Work on a Pensionado Visa"

Reality: You cannot work for a Panamanian business. If you do, you risk losing your residency. That said, most clients can run online businesses serving clients outside Panama under the right circumstances.

A Practical Path to International Freedom

Panama offers a practical residency path for Americans looking to diversify internationally.

The dollar economy reduces currency risk (although not exposure to the US dollar). The location makes travel easy. Much of the infrastructure in popular regions is reliable. And while the rules have tightened, residency remains quite accessible.

But getting it right takes some doing.

We’ve helped clients do exactly that for more than 40 years. If Panama is part of your plan, we can help you structure it properly, from start to finish. Feel free to get in touch.

Sources:

-

Embassy of Panama. (n.d.). Retire in Panama. Retrieved from https://www.embassyofpanama.org/retire-in-panama

-

Johns Hopkins Medicine International. (n.d.). Hospital Punta Pacífica. https://www.hopkinsmedicine.org/international/health-care-consulting/americas/hospital-punta-pacifica

About The Author

We have 40+ years experience helping Americans move, live and invest internationally…

Need Help?

We have 40+ years experience helping Americans move, live and invest internationally…