Currency Diversification Beyond the US Dollar

-

Written by The Nestmann Group

- Reviewed by Brandon Roe

-

Updated: May 22, 2025

Contents

- What Does "Getting Out of the US Dollar" Really Mean?

- Why Consider Currency Diversification?

- The Declining Purchasing Power of the US Dollar

- US Debt, Dollar Printing -- and the Privilege That Shields It (For Now)

- De-Dollarization Trends

- Political and Economic Instability

- The Benefits of Currency Diversification

- The Drawbacks and Challenges

- Practical Approaches to Currency Diversification

- Popular Currencies for Diversification

- Why Simply Holding Foreign Currency Accounts in the US May Not Be Enough

- Creating a Comprehensive Currency Diversification Strategy

- Common Mistakes to Avoid

- Currency Diversification as One Part of the Bigger Picture

Worried about where the economy is heading – maybe even a global currency reset? You’re not alone.

Between volatile markets, political uncertainty, and ballooning government debt, more Americans are looking for ways to keep their money safe – and globally mobile. One strategy that’s gaining renewed attention?

Protect Your Wealth From Currency Chaos.

From inflation to de-dollarization, the global monetary order is shifting – and it won’t wait for Washington to catch up.

Sign up below to get free access to our most requested strategies to legally protect your savings, your income, and your legacy.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

By signing up for this briefing, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

Currency diversification – the practice of holding assets in more than just US dollars.

At its core, it’s a simple idea: don’t tie your entire financial future to a single economy, especially one facing mounting structural challenges. Just like diversification across asset classes reduces risk, diversifying across currencies helps protect your wealth from dollar-specific shocks.

But how does it actually work in practice? And is it worth it for everyday investors?

Let’s break it down.

What Does "Getting Out of the US Dollar" Really Mean?

When people talk about “getting out of the US dollar,” they’re not suggesting you abandon the greenback entirely. It’s not about panic – it’s about balance.

The core idea is simple: don’t keep all your financial eggs in one currency basket.

Just like you diversify across stocks, bonds, and real estate to reduce risk, currency diversification means holding some of your wealth in non-dollar assets – so you’re not fully exposed to the risks tied to the US economy or Federal Reserve policy.

Here are a few common ways to diversify your currency exposure:

- Open a foreign bank account in another stable currency (or a US-based multi-currency account, if you don’t have the connections or patience for a foreign account).

- Buy real estate abroad – your asset is priced and valued in a different currency.

- Run or invest in a business that earns income in non-USD markets.

- Hold precious metals, like gold or silver – assets that aren’t tied to any one government or central bank.

Think of it like insurance for your money. You hope you won’t need it. But if the dollar takes a hit – whether through inflation, devaluation, or financial repression – you’ll be glad you have part of your portfolio sheltered somewhere else.

Recommended Reading:

- Why Have an Offshore Bank Account?

- Offshore Bank Accounts for Tax Planning

- Foreign Real Estate Investments for Americans: Why and Why Not?

- Best Gold Coins to Buy

- Best Gold Bars to Buy

- How to Store Precious Metals

Why Consider Currency Diversification?

The Declining Purchasing Power of the US Dollar

If it feels like your money doesn’t go as far as it used to, there’s a good reason for that.

The US dollar has been steadily losing purchasing power for decades. Inflation may not always be headline-grabbing year to year, but over time, it adds up in ways that quietly erode savings.

For example, according to the US Bureau of Labor Statistics Consumer Price Index (CPI), $100 in 1984 has the equivalent purchasing power of over $300 today. That’s a more than 200% increase in the cost of goods and services over four decades.

But there’s a catch.

In the early 1980s, the US government changed the way it calculated CPI. One of the biggest shifts was the introduction of hedonic adjustments, geometric weighting, and substitution — a technique that swaps out rising-cost items for cheaper alternatives.

An example: Let’s say steak used to cost $10 a pound, and now it costs $15. That’s a big jump. But instead of recording that full increase, the government changes the math. They assume you’ll stop buying steak and switch to chicken, which still costs $8 a pound. Since chicken is cheaper, the official inflation number looks smaller — even though you’re still spending more, or getting less than before.

The result? Inflation looks lower on paper than what you actually feel at the grocery store.

So if CPI had continued using the pre-1980s methodology, inflation would show a far more dramatic story — one that aligns much more closely with how Americans actually experience rising costs.

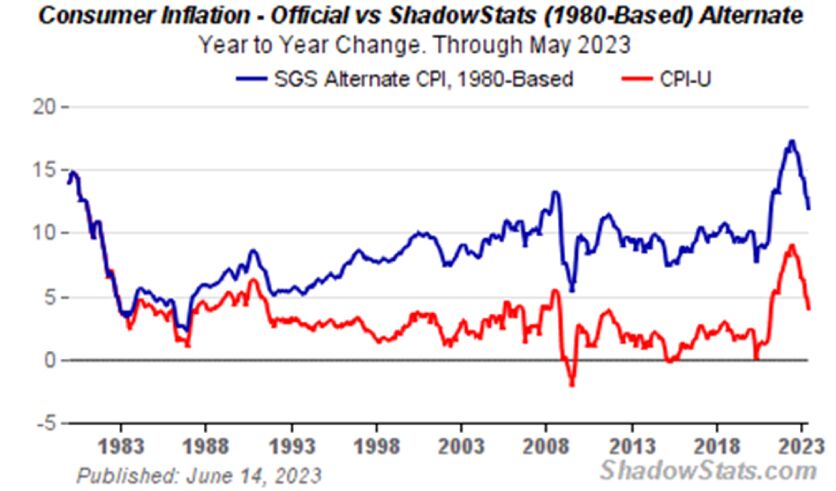

For comparison, have a look at the below chart from alternative CPI calculation service, ShadowStats:

Source: ShadowStats

Although the newest data dates back to 2023 (the latest available), it still sends a clear message:

If inflation were calculated the same way it was before the early 1980s, the long-term loss in purchasing power would be far more severe than official numbers suggest (illustrated by the blue line).

That means the true value of your dollar may have eroded far more than Washington admits — even if you don’t see it printed on an official chart.

ShadowStats is a website previously run by economist John Williams that aims to track the rate of inflation under previous methods. Some mainstream economists have criticized a certain lack of transparency about how he calculates his numbers.

However, such quibbles aside, we see it as a useful piece of data when trying to understand the full story about inflation.

So what does that mean in practical terms? If you’ve simply kept your wealth in dollars over that period, it buys far less than what it used to.

Currency diversification isn’t about abandoning the dollar. It’s about protecting against the slow drip of inflation that can quietly undermine the value of everything you’ve worked to build.

US Debt, Dollar Printing -- and the Privilege That Shields It (For Now)

The US is drowning in debt – over $36.5 trillion as of March 2025. How does the government deal with it? By creating more dollars.

In a typical economy, the currency would devalue fast. When the money supply rises faster than goods or services, each dollar in your wallet buys less. Simple math.

But the US isn’t a typical economy. It enjoys what economists call exorbitant privilege — the benefit of having the world’s primary reserve currency.

Because the dollar is used globally, foreign governments, banks, and corporations hold US dollars and buy US debt. That demand:

- Keeps interest rates lower than they should be.

- Soaks up newly created dollars.

- Delays the inflation that would normally ripple through the economy.

It’s a strange situation, where even when the US causes financial instability, the world often buys more dollars — not fewer.

We saw this clearly during COVID-19. Trillions in stimulus were added to the system. But global demand for dollars stayed strong — masking inflation longer than expected until a dramatic rise in 2021/2022.

But this system – with the US dollar as the world’s only true reserve currency — is cracking.

More countries are trading in other currencies. Central banks are diversifying away from the dollar. And when (not if) the dollar loses its reserve status – which it took from the British Pound after World War II — the cost of money printing will hit harder, and potentially faster.

De-Dollarization Trends

As a result, some countries are working to rely less on the US dollar. China and Russia, for example, now do most of their trade with each other using their own currencies instead of dollars. As of March 2024, about 92% of trade settlements between those two countries are done in yuan and rubles.

Groups like BRICS (Brazil, Russia, India, China, and South Africa) are also looking for ways to trade without using the dollar. They’ve talked about building new payment systems and even creating digital currencies to support this goal.

The dollar is still the world’s most-used currency — but it’s slowly facing more competition.

We’ve said for many years that we expect the decline of the dollar to happen over time. We were called crazy for saying so.

We’re now seeing it play out.

The BRICS De-Dollarization & What It Means for Gold

The BRICS de-dollarization is grabbing headlines. But what does it actually mean for gold… and for your portfolio. Learn more here: BRICS de-dollarization.

Political and Economic Instability

No matter what side of the aisle you find yourself, I think we can all agree that politics in the US feels more unpredictable than ever. The country is deeply divided, and big policy changes can happen quickly depending on who’s in charge.

This kind of political uncertainty can affect – and has affected — the strength and stability of the US dollar.

Holding assets in other currencies helps reduce that risk. If something happens that hurts the dollar specifically – whether it’s a new law, trade conflict, or financial policy shift – your wealth isn’t tied to just one system.

The Benefits of Currency Diversification

Protection Against US Dollar Devaluation

Hypothetically, let’s say the US dollar suddenly drops 20% against other major currencies. What would that actually mean for you?

It’s not that prices jump overnight. But your cost of living will rise.

Here’s why: When the dollar loses value, the things you buy from outside the country — energy, electronics, building materials, even food — get more expensive. That’s how inflation creeps in. Slowly at first. Then all at once.

In countries with weaker currencies or histories of high inflation, that adjustment can happen fast. In the US, it usually takes longer — but it still comes.

So while your dollar doesn’t lose 20% of its purchasing power overnight, the inflation that follows can quietly eat away at your wealth in the months that follow.

That’s why currency diversification matters. It’s not just about gains — it’s about owning something that isn’t being quietly hollowed out from the inside.

It’s a simple idea with a big impact: don’t let your financial future depend on just one currency.

Reduced Impact of US Inflation

Inflation is like a silent thief that steals your purchasing power. When prices rise in the US, investments tied to the dollar can lose value. However, holding assets in currencies from countries with lower inflation rates can help protect your wealth.

The Swiss franc is a prime example. Switzerland has a long history of maintaining low inflation, thanks in part to its strong currency. For instance, in 2022, while US inflation peaked at 9.1%, Switzerland’s inflation was significantly lower, around 3.5%.

When Brandon Roe, our Senior Associate was last in Zurich early January, one wealth manager commented that Switzerland has been in practical deflation in many areas of life for some years now.

Brandon confirmed this by heading to the local supermarket. It was true — prices of certain foods from the US were actually cheaper in Switzerland than at home.

By diversifying into currencies like the Swiss franc, you can shield a portion of your assets from the impact of US inflation, helping to preserve your purchasing power over time.

Geographic Diversification of Risk

When you diversify across currencies, you’re not just spreading your money between different types of money – you’re also spreading it across different countries and economies.

That means you’re not putting all your financial risk in one place.

If the US faces political unrest, banking problems, or economic slowdown, assets tied to the US can take a hit. But if you also hold money in countries with more stable systems or stronger economies, you’re better protected.

It’s one more layer of security – and one more reason currency diversification isn’t just about money. It’s about building a more resilient financial foundation.

Potential for Currency Appreciation Gains

Sometimes other currencies gain value against the dollar. This means you end up further ahead than when you started.

The Drawbacks and Challenges

Currency Exchange Costs

One downside of currency diversification is the cost of converting money between currencies.

Banks and currency exchange services often charge fees or spreads – the difference between the buy and sell rate. These extra costs can reduce your returns, especially if you’re switching currencies often or making smaller transactions.

For example, if the official exchange rate is 1 US dollar for 0.90 euros, a bank might offer you only 0.87 euros for each dollar. That 0.03 difference is the spread, and it adds up – especially if you’re exchanging large amounts or doing it often.

It’s best to plan ahead and choose the right institutions or platforms to keep those costs as low as possible.

Foreign Exchange Volatility

Even strong currencies move up and down in value.

While some foreign currencies may offer more long-term stability than the US dollar, they still experience short-term swings. That means your holdings could lose value temporarily – even if the long-term outlook is positive.

This kind of volatility doesn’t mean the strategy is wrong. It just means you need to be prepared for some ups and downs along the way.

Tax and Reporting Complexities

If you’re a US taxpayer and hold money or assets in other countries, you’ll face extra reporting requirements.

This might include:

- FBAR (Foreign Bank Account Report) if your total foreign accounts exceed $10,000.

- Form 8938 under FATCA if your foreign holdings pass certain thresholds.

- Other forms depending on how your accounts or assets are structured.

These forms aren’t optional. Missing or skipping them can lead to penalties, even if you don’t owe extra taxes.

The key is to stay informed.

Foreign Political and Economic Risks

Diversifying into other currencies can help protect you from problems in the US – but it also means you’re exposed to risks in other countries.

Political instability, poor economic decisions, or sudden changes in regulations can affect foreign currencies too. Just because a currency seems strong today doesn’t mean it’s safe from future trouble.

That’s why careful selection and regular review are key parts of any currency diversification plan.

Practical Approaches to Currency Diversification

1. Foreign Currency Bank Accounts

Domestic Multi-Currency Accounts

If you want a simple way to get started, some US banks and brokers offer multi-currency accounts. These let you hold and exchange several major currencies from a single platform.

Examples include:

- Interactive Brokers.

- Charles Schwab Global Account.

- Citibank Global Currency Account.

These accounts are convenient, especially for beginners. But keep in mind – they’re still a part of the US banking system.

Foreign Bank Accounts

Another way to diversify outside the US is by opening a foreign bank account.

If you don’t have a residency permit in your nation of choice, the right preparation, guidance, and connections can increase your chances of opening a foreign bank account – but you’ll need a healthy supply of patience.

Some countries where Nestmann clients have successfully opened accounts include:

- Switzerland – Known for financial stability and client confidentiality. While not universally useful for most American clients, it remains a strong option for those looking to make large deposits.

- Austria – Offers reputable private banking with a focus on conservative asset management. Personal introductions are often helpful.

- Mexico – Most useful for Americans who spend time in-country or plan to seek residency. While it’s possible to open an account as a non-resident, most clients do so after getting legal residency, which makes the process much smoother.

- Canada – Accessible for US citizens with existing ties to the country, although you don’t need to be resident there. While privacy laws are aligned with US standards, Canadian banking can support cross-border living and facilitate Canadian dollar exposure.

Just remember: the IRS wants to know about these accounts. Any US person with foreign accounts totaling over $10,000 at any point during the year must file an FBAR. Skip this step, and you could face serious penalties. There is no such thing as holding money offshore without having to report it.

2. Physical Currency Holdings

In some cases, it makes sense to hold foreign cash directly.

Having physical currency gives you instant access in an emergency, without relying on banks or digital systems. It can be especially useful when traveling or during temporary disruptions.

But there are trade-offs. You’ll need to think about safe storage and security. And since physical cash doesn’t earn interest, most people only keep small amounts – enough for travel or short-term emergencies.

3. Foreign Currency ETFs and Funds

If you’re not ready to open a foreign account, you can still get exposure to other currencies through exchange-traded funds (ETFs). These are easy to buy and sell through a regular brokerage account.

Examples include:

- CurrencyShares Swiss Franc Trust (FXF).

- Invesco CurrencyShares Euro Currency Trust (FXE).

- WisdomTree Bloomberg US Dollar Bullish Fund (USDU).

These ETFs let you track currency movements without holding the actual cash. But remember – since they’re still based in the US, they don’t offer the same level of separation as holding money in another country.

4. Foreign Real Estate

One of our favorite strategies: buy property in stable foreign countries. This gives you currency diversification PLUS a tangible asset that can appreciate and generate income. Good places to look:

- Portugal.

- Panama.

- Mexico.

- Costa Rica.

Did you know that in Costa Rica, foreign buyers have the same property rights as locals – including full title ownership? That’s not as common as you might think and one of the reasons it’s historically been a top pick for US investors looking for both lifestyle and currency diversification.

We’ve been helping American clients purchase foreign real estate for global mobility and currency diversification since 1984. If you’re interested, feel free to get in touch.

5. Precious Metals

Gold, silver, and other precious metals have protected wealth for thousands of years.

They don’t rely on any government or central bank, and they often hold their value when paper currencies lose ground. That’s why metals are commonly used to guard against inflation and currency devaluation.

Take the most recent record gains in gold. It has zoomed over the past few years as volatility in the economy, in the markets, and now in government policy have created a great deal of fear out there:

It’s common to store your metals in secure vaults outside the US, too – in countries like Switzerland, Singapore or New Zealand. This adds another layer of separation from the US financial system.

Popular Currencies for Diversification

Not all foreign currencies are created equal. Some are better bets than others.

Here’s a simple breakdown of some options that have shown significant appreciation against the US dollar since January 2025:

Swiss Franc (CHF)

What’s great about it:

- Super stable with low inflation for decades.

- Backed by a government that doesn’t spend wildly.

- Strong banking system.

- Where people run when things get scary in the world.

Switzerland’s currency is considered one of the most stable in the world. Why? Because of their political stability, transparency, and conservative approach to money.

Things to watch out for:

- Can be expensive to hold sometimes due to negative interest rates.

- Might be priced higher than other currencies.

Canadian Dollar (CAD)

What’s great about it:

- Backed by tons of natural resources.

- Stable banking system and government.

Things to watch out for:

- Often moves with the US economy (not great for diversification).

- Goes up and down with commodity prices.

Australian Dollar (AUD)

What’s great about it:

- Resource-backed economy with strong ties to Asia.

- Usually offers higher interest rates.

- Stable political environment.

Things to watch out for:

- Vulnerable to changes in commodity prices and China’s economy.

- Can be volatile during global crises.

New Zealand Dollar (NZD)

What’s great about it:

- Stable political environment.

- Often offers higher interest rates.

- Strong agricultural exports.

Things to watch out for:

- Small economy can lead to price swings.

- Vulnerable to changes in global dairy prices.

Why Simply Holding Foreign Currency Accounts in the US May Not Be Enough

Lots of Americans think they’re covered if they just open a multi-currency account at Interactive Brokers or similar US institutions.

But there are some serious limitations you need to know about:

1. Still Within the US Financial System

Here’s the thing: multi-currency accounts at US institutions can still be grabbed by US authorities. In a serious crisis, these assets could be frozen, seized, or subjected to capital controls.

While an offshore bank account doesn’t inherently provide asset protection benefits, it makes the process more difficult against people chasing your money.

2. Counterparty Risk

Your foreign currency holdings are only as safe as the bank or broker holding them. If that institution gets into trouble, your diversified currencies could go down with the ship – just like your dollars.

3. Limited Protection from Systemic US Financial Risks

When your currencies are in the US system, they’re still exposed to problems that could affect the entire US financial system. True diversification means geographic diversification, too.

You Can Diversify Your Assets – or Just Think You Did

Most investors buy foreign currencies through US institutions and think they’re protected.

But holding foreign currencies through US banks still leaves you fully exposed to US banking system failures, capital controls, and regulatory changes.

Our complete Jurisdictional Diversification Guide, available through the Nestmann Inner Circle, covers:

-

The critical difference between currency and jurisdictional diversification that most investors miss.

-

Why $36 trillion in US debt creates unprecedented pressure on your wealth.

-

How to build true protection through multi-jurisdictional structures and the Swiss advantage.

-

Real-world strategies for escaping the “home bias” trap that keeps your assets vulnerable.

Creating a Comprehensive Currency Diversification Strategy

Let’s talk about how to build a strategy that actually works for your situation:

1. Assess Your Personal Risk Profile

Ask yourself:

- What’s my time horizon?

- How much money do I have, and how much can I put into currency diversification?

- Where does my income come from? Is it all in dollars already?

- How comfortable am I dealing with international finance?

- What’s my tax situation?

2. Figure Out Your Goals

Be clear about what you want:

- Are you mainly trying to protect against the dollar tanking?

- Are you hoping to actually make money from currency moves?

- Do you need quick access to foreign currencies for travel or business?

- Are you creating a full “Plan B” that includes possibly relocating?

3. Pick the Right Currencies

Based on your goals, choose currencies that make sense. Want stability? The Swiss franc is a strong choice. Prefer currencies backed by natural resources? Look at the Canadian dollar, Norwegian krone, or Australian dollar.

4. Use Multiple Approaches

Don’t put all your eggs in one basket:

- Foreign bank accounts in several countries.

- Some physical cash for emergencies.

- Maybe some foreign real estate.

- Precious metals stored outside the US.

- Businesses or investments that make money in foreign currencies.

5. Stay on the Right Side of the Law

We partner with an extensive legal network of professionals who know international tax rules to help you:

- File your FBARs correctly.

- Handle FATCA compliance.

- Report all income properly.

- Keep good records of all foreign transactions (so you don’t have to).

6. Review and Adjust Regularly

Set up a schedule to:

- Look at your currency mix once a year.

- See how you’re doing against your goals.

- Adjust based on what’s happening in the world.

- Update as your own situation changes.

An American client originally from Ukraine once lost access to his Czech bank account — despite owning property there.

Why? Because during a routine compliance update, the bank decided they didn’t like that he was a US citizen of Ukrainian origin. After numerous attempts, he couldn’t get a Czech bank to reopen an account for him. Property ownership wasn’t enough.

It took nearly 7 months, 4–5 rejections, but we were finally able to get two banks to say yes.

The takeaway: Compliance rules can close doors fast — even when you’ve done everything “right.” We were able to leverage our contacts to help this client push through the roadblocks. It’s a strong reminder:

Don’t go it alone when building an international strategy.

Common Mistakes to Avoid

1. Putting All Your Eggs in One Foreign Basket

Some folks just swap dollar concentration for euro concentration or yen concentration. That’s not true diversification. Spread your risk across several different currencies based on different economic situations.

2. Ignoring Reporting Requirements

The IRS doesn’t mess around with foreign accounts. US persons must file an FBAR if they have foreign financial accounts totaling over $10,000 at any time during the year. Don’t try to hide these accounts – the penalties can be steep.

3. Chasing High Interest Rates Without Understanding the Risks

See a bank CD offering 8% interest in a foreign currency when the dollar offers 2%? There’s probably a reason. Higher interest rates usually mean higher risk or expected inflation. Don’t just chase yield without understanding what’s going on in that country.

4. Falling for Offshore Scams

The offshore world is full of smooth-talking scammers. Stick with established, reputable financial institutions, especially when dealing with unfamiliar countries. Or come to someone who knows the players – who to do business with and who to avoid.

5. Forgetting About Taxes

The IRS wants its cut of your currency gains. Remember that even foreign currency fluctuations can create taxable events, even when you’re not actively trading.

Currency Diversification as One Part of the Bigger Picture

Currency diversification isn’t about making a political statement or abandoning the US dollar. It’s about smart risk management in an unpredictable world. When you spread your assets across multiple currencies and countries, you create a safety net against financial problems that might hit the US especially hard.

There’s no one-size-fits-all approach here. The best strategy combines multiple methods tailored to your specific situation and goals.

This might mean foreign bank accounts, real estate, businesses, or investments that give you exposure to different currencies and economic systems.

Yes, currency diversification creates more complexity. That’s why working with experienced professionals who understand both international finance and US reporting requirements is so important.

At The Nestmann Group, we’ve been helping Americans protect their wealth through international strategies since 1984. We know how to navigate the complexities of foreign currencies, offshore banking, and international compliance, and we can create customized solutions that fit your specific needs.

Don’t wait for a crisis to start thinking about currency diversification. The best time to diversify is before you need to, when markets are calm and options are plentiful.

If you’re ready to see how currency diversification fits into an overall wealth protection plan custom-tailored for your prosperity, feel free to get in touch.

About The Author

We have 40+ years experience helping Americans move, live and invest internationally…

Need Help?

We have 40+ years experience helping Americans move, live and invest internationally…