Swiss Asset Management for US Investors: Benefits, Risks, and How to Start

-

Written by The Nestmann Group

- Reviewed by Brandon Roe

-

Updated: July 9, 2025

Contents

- What “Swiss Asset Management” Really Means

- #1. Access to Global Markets

- #2. Built-In Currency Diversification

- #3. A Conservative, Long-Term Approach

- #4. Predictable Rules and Institutions

- Important Considerations for American Investors

- #1. You Must Report Everything

- #2. Not All Swiss Firms Work With Americans

- #3. Some Investments May Be Less Liquid

- #4. It May Cost More – and Feel Less “Tech-Forward”

- Common Misconceptions About Swiss Wealth Management

- So, Is Swiss Asset Management Right for You?

- How to Get Started: Your Swiss Asset Management Connection

- So is Swiss asset management right for you?

- Sources

As an American, you can probably feel the world shifting. The percentage of US dollars in reserve currency status is the lowest it’s been in decades. Geopolitics is getting louder. And the typical wealth management toolbox you probably rely on is starting to feel outdated.

But if you’re thinking longer-term—and quietly asking yourself where all of this is headed—Swiss asset managers still offer real advantages.

Free Wealth Protection Insights

Enter your email below to receive our weekly briefings on better ways to preserve your wealth, legally reduce your tax bill, and better protect what you’ve worked hard to build.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

PLEASE NOTE: This e-series will be delivered to you via email. You should receive your first message minutes after joining us. By signing up for this course, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

There’s a lot the Swiss have to offer, mixed in with a lot of misinformation about what that actually means.

That’s why, in this piece, we’ll walk you through what Swiss asset management really looks like for Americans:

What it offers.

What it doesn’t.

Who it’s for.

Who it’s not for.

And how to know if it’s a fit for your broader wealth strategy.

What “Swiss Asset Management” Really Means

Swiss asset management isn’t just about parking cash in a numbered account. It’s about working with professionals who manage wealth across borders, often with a focus on long-term stability.

In 2024, Swiss institutions oversaw a record 3.45 trillion Swiss Francs (CHF) in assets—one of the largest totals in Europe. About a third of that came from clients outside Switzerland.

This isn’t just a side business. It’s the foundation of the country’s financial sector.

If you have $1-$2 million to invest, here’s what that can mean for you:

#1. Access to Global Markets

Although you can mimic offshore asset exposure using ETFs in the US, an account in Switzerland gives you the opportunity to invest offshore directly.

This is important as a wealth protection tactic. In most cases, it’s safer to hold a portfolio of stocks and bonds than an ETF.

#2. Built-In Currency Diversification

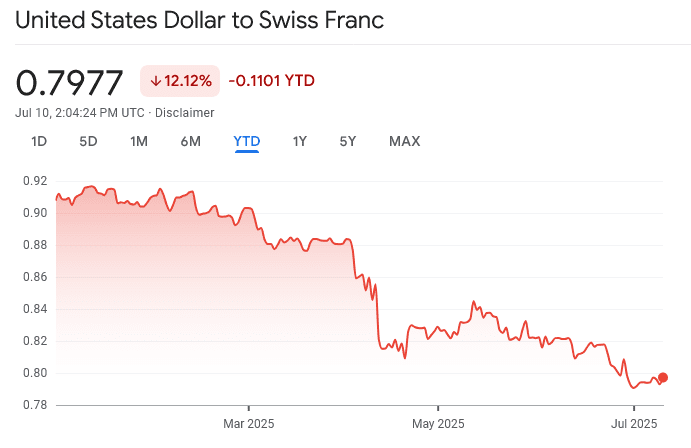

Since the 1980s, the US dollar has consistently lost value against the Swiss Franc, but more recent numbers tell the same story:

“Should I get out of the USD entirely?”

That’s a question we get almost on a daily basis. And the answer is, maybe. Like anything involving investments, there are pros and cons.

But if you are exploring the option, the key term to know is “Ex-USD portfolio”. That’s an industry term that tells the asset manager you want as little exposure to the dollar as possible—no US stocks and no holding denominated in dollars.

#3. A Conservative, Long-Term Approach

Swiss asset managers generally don’t chase quarterly returns. The focus tends to be steady growth, risk mitigation, and preserving purchasing power over time.

#4. Predictable Rules and Institutions

Switzerland is known for financial stability. Not just in markets, but in its legal and regulatory systems. Although this can sometimes make the culture feel a little too traditional, when it comes to finances, that’s a good thing.

Read More: Best Swiss Banks

Important Considerations for American Investors

Swiss money management isn’t a fit for everyone. If you’re seeking the next big tech darling or risky speculative trades, you may be better off elsewhere.

For Americans, the rules are stricter than they used to be. And the experience may be different from what you’re used to with a US-based advisor.

Here are some key considerations:

Jump to: Common Misconceptions About Swiss Wealth Management

#1. You Must Report Everything

There is no secrecy. As a US taxpayer, you must report foreign accounts to the IRS.

Depending on how your account is set up, the rules can be complex and missing a form can lead to penalties—even if you owe no tax.

#2. Not All Swiss Firms Work With Americans

Due to strict US regulations, most Swiss banks will not open accounts for Americans unless you’re working with a Swiss asset manager who is registered with the SEC—and account minimums are usually in the millions.

And even then, thanks to the Foreign Account Tax Compliance Act (FATCA), some Swiss banks simply won’t work with Americans at all. They don’t want the compliance trouble.

Before he became a client, a dual Belgian-American citizen applied for a Swiss bank account using only his Belgian passport. But during routine checks, the bank uncovered his US citizenship—and immediately shut down the process.

If you’re planning to open a Swiss account, transparency matters. Banks dig deep. That’s why working with professionals—those who can save you from the expensive headaches—is worth every penny.

#3. Some Investments May Be Less Liquid

Swiss portfolios are usually built for long-term goals. That means parts of your portfolio may not be easy to sell quickly.

If you plan to hold an account for the short-term (less than two years), or you need to take regular withdrawals, you’ll want to make sure your asset manager is aware of this.

#4. It May Cost More – and Feel Less “Tech-Forward”

Like many US-based wealth managers, Swiss firms often charge based on the total value of your account. You may also find fewer digital tools or flashy apps compared to US brokerages (more on this later).

If you value ease of access or real-time tracking, you might find the Swiss model a bit slow.

In some cases, they even consider this a strength. One bank, in particular, was proud not to offer online access until just this year.

They promote this as a feature because with fewer connections to the Internet, and a heavy focus on cybersecurity, they believe this offered their clients a more secure banking experience.

Common Misconceptions About Swiss Wealth Management

Anne Liebgott is a trusted contact in Zurich, Switzerland, who has been involved in the Swiss wealth management and banking industry for decades.

We asked for her perspective on a few key questions we hear from clients.

Q: What common misconceptions do American investors have about Swiss banking and wealth management?

A common misconception is that Swiss banking is secretive or inaccessible, particularly for Americans. In reality, Swiss banks are highly transparent, internationally compliant, and accustomed to working with US clients in collaboration with a Swiss wealth manager registered with the Securities and Exchange Commission as an Investment Advisor.

Another myth is that Swiss wealth management is only for the ultra-wealthy; in fact, many SEC-registered wealth managers offer tailored solutions for high-net-worth individuals across a range of profiles.

Some also believe that opening a Swiss account requires traveling abroad—but today, the entire process can be completed remotely, with proper guidance.

Finally, Swiss accounts are often seen as complex or “off the grid,” when in fact they can be fully declared and efficiently integrated into a compliant global wealth plan.

Q: How does the experience of working with a Swiss wealth manager differ – positively or negatively – from working with a US institution like Merrill Lynch or Morgan Stanley?

Working with a Swiss wealth manager typically offers a more personalized, private, and internationally minded approach. Unlike large US firms, Swiss investment advisors often maintain boutique structures with direct client access to senior decision-makers, fostering long-term relationships rather than product-driven transactions.

On the downside, US-based investors may find fewer digital tools or branded platforms compared to the slick interfaces of big US institutions.

However, for those seeking discretion, global diversification, and a high-level experience, the Swiss model can be a welcome shift from the scale and bureaucracy of major US banks.

Q: Some Americans believe that once their money is moved to Switzerland, it becomes hard to get it back. Is that concern justified?

That concern is largely outdated and unfounded. Funds held in Switzerland can be transferred back to the US or elsewhere without restriction, assuming the account is properly structured and tax-compliant.

Swiss banks are known for operational efficiency, and international transfers are typically fast and secure.

Jump to: How to Get Started

So, Is Swiss Asset Management Right for You?

Swiss asset management isn’t the right move for everyone. A good client tends to check the following five boxes.

#1: Have $1 to $2 million (or more) in investable assets.

Most Swiss managers have minimums starting in this range, especially for US clients.

You don’t have to be ultra wealthy. But these minimums reflect the cost of compliance and the personalized nature of the service. Below this threshold, you may find the fees outweigh the benefits.

If you do your research, you may occasionally come across advisors who will start with a mandate as low as $500,000. Frankly, we haven’t had so much success with those accounts.

The reason why is usually one of the following:

-

In order to deliver a high level of service, their fees have to be very high. One advisor charges around 2% all in per year. That gets you a very high level of service, but that’s also very expensive.

-

The client keeps bumping into minimums. Some asset managers and the banks that hold the funds have minimum fees, regardless of what the headline percentage rate is. So a firm may promote a headline rate of 1.25-1.4% (reasonable) but after bumping up against minimums, the effective fee is still about 2%.

-

They get very little service, or the account gets pushed onto the most junior of the team. This happened to one client of ours who was placed with, in the words of our client, “very young and very nervous”. Now, to his credit, the founder of the firm was on that first call too. And he was very helpful when I raised the client’s concern. But still, it doesn’t make a good impression.

Now, that’s not to say we can’t make smaller mandates work—I just pulled a few strings to get approval for a $150,000 IRA. But that’s more a reflection of our experience in the space.

If you’re calling up an asset manager cold, be careful.

As a hotel receptionist once told me as I grumbled about having to pay to offload my bags at the drop-off zone, “There is no free lunch in Switzerland.”

#2: Want real international diversification.

Most people think you’re diversified if you hold a global mutual fund. And to some degree, ETFs do allow broad market exposure.

But that’s not real international diversification—you’re still very much exposed to US-based political, economic, and financial system risk.

#3: Prioritize wealth preservation over fast growth.

If your main focus is keeping what you’ve built—especially across generations – Swiss managers may be a good fit.

Their approach is typically conservative, long-term, and usually focused on protecting purchasing power with a comfortable return. But they generally won’t take risks unless you specifically tell them too (and even then, they may push back).

#4: Can handle a little more complexity (or don’t mind someone else handling it for you).

Cross-border wealth planning involves more moving parts: FATCA reporting, SEC-registered advisors, currency issues, and potential estate planning tweaks.

It’s not overwhelming—but it does take attention—and, most importantly, the right team.

#5: Have higher fees than an ETF that tracks the S&P 500.

Swiss wealth management rarely claims to compete on price. But like much of the asset management industry, they’ve felt the pressure to lower fees to competitive rates. You might be surprised to learn that we’re now seeing Swiss asset managers priced lower than mainstream active management in the US.

The catch, of course, is the high minimums. Switzerland is a low-tax, high-wage paradise where an entry-level asset manager can earn more than CHF 100,000 (about $125,000 as of July 8, 2025). In order to pay for this talent, the asset management firms need to charge competitive rates over a greater pool of capital.

But for investors who value access, relationships, and global perspective, the service model can feel more tailored than US retail options.

Swiss asset management is a tool—not a finish line. It works best when it’s part of a larger wealth strategy that also considers the whole picture.

Done right, it can help you preserve wealth across currencies, countries, and generations. But it should be entered into with your eyes open, and with the right support behind you.

How to Get Started: Your Swiss Asset Management Connection

We’ve spent decades helping clients explore Swiss asset management—not as a one-size-fits-all solution, but as one piece of a broader wealth strategy.

We don’t push products or steer you toward any single provider. Instead, we help you find the right fit based on your specific needs, goals, and long-term plans. It’s a strategy-first approach, not product-centered.

Here’s our approach:

#1: Firm Vetting

We maintain relationships with carefully vetted Swiss asset managers who understand the needs of American clients. These are professionals with required SEC registration, strong compliance systems, and a long history of international work.

#2: Needs Assessment

Before making any introductions, we take the time to learn about your financial goals, your risk preferences, and how a Swiss relationship might fit into your bigger picture. If it doesn’t make sense—we’ll say so.

#3: Ongoing Support

We work hard to take as much of a paperwork burden off of you as possible. And we’re a second set of eyes to make sure everything gets done the right way the first time, whether you’re opening an individual account, through a company, a trust, or even IRA (self-directed and Checkbook structures).

#4: Compliance Guidance

We’ll help you understand the US tax reporting and filing requirements that come with international accounts—and are often asked to work with our tax partners to put these together every year.

So is Swiss asset management right for you?

Maybe. But, if you at least meet the financial minimums ($1 million), it’s worth a discussion.

Feel free to get in touch. We’re happy to help you figure out what comes next.

Sources:

-

Asset Management Association Switzerland. (2025). Swiss Asset Management Study 2025. https://www.am-switzerland.ch/en/services/data-and-reports/swiss-asset-management-study/swiss-asset-management-study-2025

-

Setser, B. (2024, March 27). The dollar’s global role and the financing of the U.S. external deficit. Council on Foreign Relations. https://www.cfr.org/blog/dollars-global-role-and-financing-us-external-deficit

-

U.S. Department of the Treasury. (2024, June 27). Agreement between the United States of America and Switzerland to improve international tax compliance and to implement FATCA. https://home.treasury.gov/system/files/131/FATCA-Agreement-Switzerland-6-27-2024.pdf

About The Author

We have 40+ years experience helping Americans move, live and invest internationally…

Need Help?

We have 40+ years experience helping Americans move, live and invest internationally…