Buying Property in Italy: A Practical Guide for US Families

-

Written by The Nestmann Group

- Reviewed by Brandon Roe

-

Updated: July 1, 2025

Contents

- Why Buying Property in Italy Appeals to American Buyers

- 1. Lifestyle Meets Legacy

- 2. A Steady Real Estate Market

- 3. Broad Regional Opportunities

- And Why It Might Not Appeal to American Buyers

- 1. Slower Pace, Slower Service

- 2. English Isn’t a Guarantee

- 3. The Tax System Is Complex and Often Unfriendly to US Citizens

- 4. Buying Property ≠ Residency

- The Real Estate Purchase Process in Italy: Step by Step

- Step #1: Property Search and Local Due Diligence

- Step #2: Making an Offer

- Step #3: Setting the Preliminary Contract

- Step #4: Conducting Legal and Technical Review

- Step #5: Final Signing with the Notary

- Client Case Study

- Common Pitfalls – and How to Avoid Them

- Beyond the Purchase Price: What You’ll Actually Pay

- It’s About Strategy, Not Sentiment

- Sources

In 2025, the movie La Dolce Villa hit Netflix – inspired by Italy’s now-famous “1-euro home” program – documenting an American couple who tries to rebuild their lives (and a crumbling Sicilian farmhouse) after selling their tech startup.

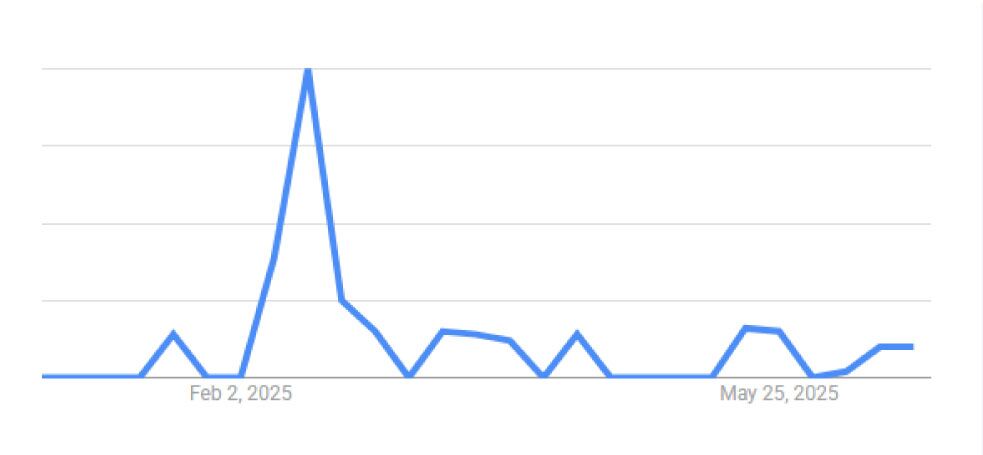

Unsurprisingly, it lit a spark of renewed interest in the country’s real estate market. Seriously: the week after the movie came out in February, Google searches for “1 euro house Italy” jumped by 250%.

Planning to Buy Property Abroad? Start Here.

Before you sign anything overseas, make sure you know what you’re doing.

Our most popular expert resources – on structuring, taxation, legal pitfalls, and due diligence – are yours, free.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

By signing up for this briefing, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

And while the 1-euro house headline grabs attention, real estate in Italy in general has become quite popular among Americans eyeing the exit.

That’s because Italy offers a mix of things many clients look for: a safe jurisdiction, strong property laws for foreigners, and a lovely place to spend some time.

In this article, we’ll walk you through exactly how to buy property in Italy – with clear, practical insights on property rules, tax traps, due diligence, and how to connect your investment to a bigger wealth protection plan.

Why Buying Property in Italy Appeals to American Buyers

1. Lifestyle Meets Legacy

Whether it’s a farmhouse in Tuscany or a penthouse in Florence, Italian real estate offers more than square footage – it gives you a foothold in an attractive place to live.

For globally minded families, this can also lay the foundations for European “Plan B” that provides lifestyle benefits today, and options for tomorrow.

Read more: Best Places to Live in Italy for Americans

2. A Steady Real Estate Market

It’s not just the homes going for 1 euro that are attracting attention.

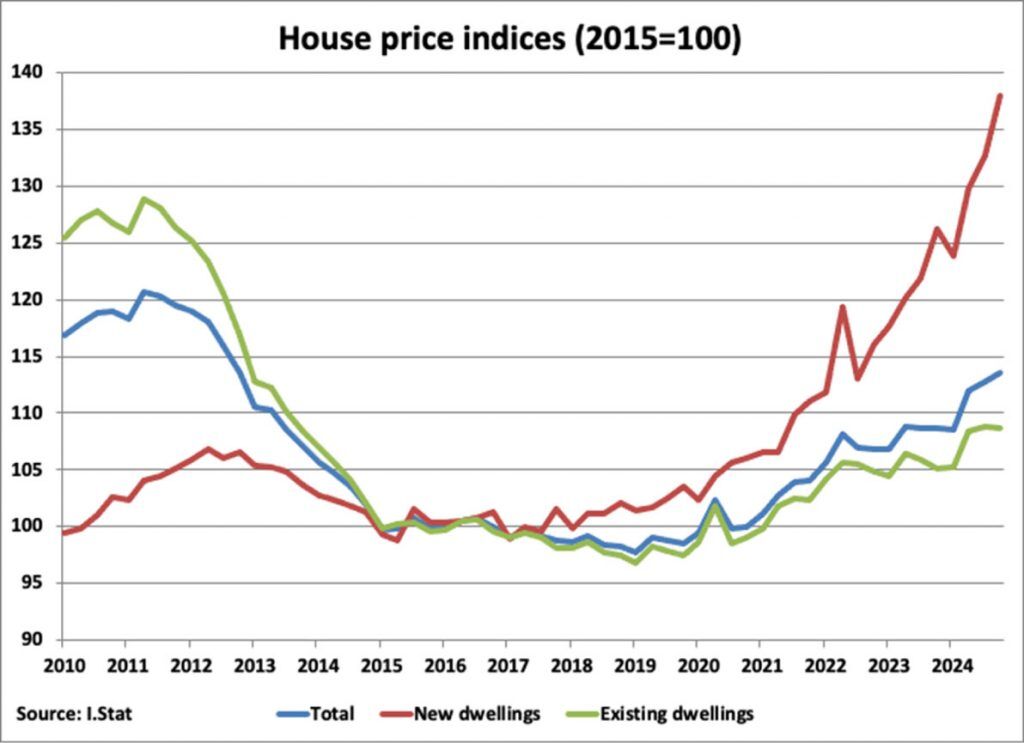

Nationwide, home prices in Italy rose by 4.5% in the last quarter of 2024, according to Global Property Guide’s 2025 residential analysis of Italy’s housing market. That’s the strongest annual growth the country has seen since mid-2022 – and marks a steady climb from earlier in the year.

Throughout 2024, home prices rose at a measured pace: by 1.6% in Q1, 2.9% in Q2, and 3.8% in Q3. This is a market that’s gaining momentum – with no current signs of overheating.

How house prices have moved in Italy from 2010 to 2024:

Source: Global Property Guide, Italy Residential Property Market Analysis 2025

3. Broad Regional Opportunities

Italy’s pricing spreads are wide – from around €1,200 per square meter in Catania (a coastal city in southern Sicily) to €4,500+ in Venice and Milan, according to Global Property Guide.

That means you’re not locked into just one type of investment. You can build a strategy around short-term rentals in Florence, long-term family homes in Umbria (central Italy between Tuscany and Rome), or lifestyle footholds along the Puglian coast (the sunny heel of Italy’s boot).

And Why It Might Not Appeal to American Buyers

For all its beauty, history, and lifestyle perks, Italy has its quirks – and they’re not always charming.

If you’re thinking about buying property in Italy or building a cross-border plan that includes time there, here are some things to consider first.

1. Slower Pace, Slower Service

As an American – when you think European – think slow.

In 2025, many government processes and businesses in Italy still rely on local offices. Even though more services are available online, a lot of Italians still prefer to handle things in person – about half the population would rather speak face-to-face than use digital tools (some of the slowest internet adoption in the EU).

So, need a plumber? Might take a little while. Waiting on a notary to process a title? Expect a few weeks. Government strikes, seasonal closings, and hours-long closures in the middle of the day (officially for lunch) are part of daily life – especially outside the cities.

For Americans used to 48-hour turnarounds and Amazon-style efficiency, this can be a real adjustment.

2. English Isn’t a Guarantee

In tourist zones and larger cities (Rome, Florence, Milan), English is common. But if you’re looking at more affordable or less crowded areas – like Abruzzo (east of Rome on the Adriatic coast), Le Marche (central Italy’s overlooked wine region), or Puglia – you’ll need to know some Italian.

Many local officials, contractors, and service providers still speak little or no English there. If you don’t speak Italian, you’ll need a translator or a trusted legal rep to handle even routine matters.

3. The Tax System Is Complex and Often Unfriendly to US Citizens

Italy uses a global income tax model tied to residency. That means, if you become a tax resident, you’re taxed on all your income – even if it’s earned in the US. While there are treaties and tax credits that help prevent double taxation, the rules are complicated.

Italy’s Flat Tax Program

In 2025, Italy still offers its €200,000 (about $228,000) flat tax program, but it only applies if you become a tax resident.

That means either:

-

Officially registering as a tax resident with Italian authorities, or

-

Spending more than 183 days in Italy in a given year (even unintentionally) and having the paperwork or ties to back it up.

And – in most cases – you can’t get Italian residency without becoming a tax resident, too.

The only real exception is the Investor Visa, which lets you obtain Italian residency without immediately triggering tax residency – but that requires a qualifying investment (like €250,000 in a startup or €2 million in government bonds) and doesn’t suit most second-home buyers.

If you’re just looking to spend a few months a year in your Italian property – or use it as a vacation home – this flat tax regime won’t apply. It’s meant for full-time, declared tax residents. And if you do become tax resident in Italy, your global assets and income will become part of the conversation.

Read more: The Italy Flat Tax Regime: Still Attractive?

4. Buying Property ≠ Residency

This is one of the most common misunderstandings we see. Buying a home in Italy does not give you the right to live there long-term.

Even in 2025, there’s no automatic visa or residency tied to ownership. If you want to stay more than 90 days at a time, you’ll need to apply for a long-stay visa – and these come with income, insurance, and paperwork requirements.

Read more: Italy Investment Visa Options for Americans

The Real Estate Purchase Process in Italy: Step by Step

Buying real estate in Italy isn’t terribly hard – it’s just different. And like any foreign market, the risks tend to hide in the small details.

Here’s how the process generally works in 2025:

Step #1: Property Search and Local Due Diligence

Start with the right kind of property in the right kind of place.

For investment properties, focus on areas with:

-

Year-round demand (not just peak tourist season).

-

Close proximity to airports or large cities.

-

Basic amenities within walking distance – especially if you plan to rent to expats or visitors.

Be cautious with remote or seasonal towns unless you plan to live there full-time. Cash flow in tourist-only regions tends to swing wildly between high and low seasons.

Also important: Think about climate risks. That cute coastal cottage might look perfect — but constant exposure to salt air can wreck plumbing, windows, and electrical systems, leading to high maintenance costs over time.

Last but not least, hire a bilingual real estate agent who knows how to work with Americans. Italy is a civil law country, and contracts may not work the way you’re used to. Without a guide, you risk missing key protections.

Step #2: Making an Offer

Formal offers in Italy are made using a Proposta d’Acquisto – a document that outlines your terms, timelines, and a small initial deposit to reserve the deal. This is where negotiations really begin.

If the seller accepts, the next step – the preliminary contract – is more binding.

Step #3: Setting the Preliminary Contract

The compromesso is the preliminary contract. It locks in the price, includes a timeline for closing, and spells out what happens if one party backs out. At this stage, you’ll pay a larger deposit – usually 10–20% of the price.

If you cancel for reasons not outlined in the contract, you may lose your deposit. If the seller cancels, they often owe you double.

This is also the moment when you should start thinking ahead to:

-

Whether you plan to rent the property.

-

What kind of management will be in place (or not).

-

How quickly you’ll move from ownership to use or income.

It’s easy to overlook that owning the property itself is just step one. If you can’t manage the property, maintain it, or make it cash-flow-positive, it may quickly become a burden.

Step #4: Conducting Legal and Technical Review

At this point, your legal and technical team should step in. A licensed Geometra or Architetto will inspect the home for code violations, unpermitted additions, or major repair risks.

A lawyer should also verify:

-

Clean title and seller identity.

-

No back taxes, liens, or unpaid utilities.

-

Zoning rules (especially for rural land).

-

Permit history (older homes often have missing or non-compliant renovations).

Even something like a missing fire escape on an apartment building can turn into a legal headache. That’s why we never skip this step for our clients – and neither should you.

Step #5: Final Signing with the Notary

Italy requires a public notary (notaio) to complete all real estate transactions. But the notary’s job isn’t to protect your interests – it’s to make sure the paperwork meets legal requirements and is correctly registered with the land office. They can’t comment on whether the agreement itself is appropriate or not.

The final signing – called the rogito notarile – typically happens at the notary’s office. You can attend in person or appoint someone to attend on your behalf using a power of attorney.

Once it’s signed and registered, you’re the legal owner.

A good foreign property isn’t just about the purchase price – it’s about what happens after. Ask yourself:

Who will manage this if I’m not here?

Can I get it cash-flowing quickly?

Are there any tax or legal traps waiting down the line?

These are the questions that turn a flashy listing into a smart part of your global wealth strategy.

CLIENT CASE STUDY:

Purchasing Property in Italy

Background: Over the years, multiple clients have purchased property in Italy. Florence has been particularly popular, thanks to its cultural appeal and a long-standing expat presence. Most of the time, clients are looking for a place where they want to spend time, but one that still has an investment case.

In one instance, we worked with a US client who purchased property in Florence as part of a broader international diversification strategy.

Problem: The client in question already spent quite a bit of time in Europe and wanted to be involved in the process. But they were also aware that Italy’s bureaucracy can be difficult and they didn’t want to waste time or money making mistakes.

They were concerned about getting in trouble if they missed something they would never have thought to ask; the “unknown unknowns”.

Solution: In most foreign property purchases, clients prefer us to take a lead and give them a turn-key solution.

But in cases like this, we act as a guide, in coordination with local lawyers and notaries. We help to arrange the details and coordinate with the various parties on both the US and Italian side to minimize complications and tax issues, and to help them avoid falling into common traps because no one thought to warn them.

Lesson: Italy can offer some great opportunities. But when buying in another country, it pays to work with a team that understands all aspects of the process — purchase, hold, sale, and sometimes even estate planning.

Common Pitfalls – and How to Avoid Them

Like anywhere outside your home country, buying property in Italy can trip you up if you don’t know the system.

Here are some of the most common mistakes we’ve seen – and how to avoid learning the hard way:

Read More: 8 Pitfalls of International Real Estate

#1. Under-the-Table Payment Schemes

It’s not uncommon in Italy for a seller to ask you to report a lower purchase price on the official documents – and pay the rest in cash.

They might frame it like this: “You’ll save on taxes, I’ll save on taxes, everyone wins.” They may even offer you a better deal as an incentive.

Don’t fall for it.

This practice is illegal. If you’re caught, you’ll face steep fines and risk losing the property. No amount of short-term “savings” is worth the legal risk.

The fix: Declare the full purchase price, every time. And walk away from any deal that suggests otherwise.

#2. Language Gaps That Hide Problems

Most property documents, contracts, and public records in Italy are written in Italian – and official versions must be in Italian to be valid. That creates two challenges:

-

You might sign something you don’t fully understand.

-

You might miss details that create legal or tax issues later.

The fix: Always use a qualified legal translator – not Google Translate. Have them walk you through every part of the contract before you sign.

#3. Bureaucracy That Moves at Its Own Pace

Italy has made progress in digital services, but real estate still requires in-person steps, stamps, and signatures – sometimes from different government offices that don’t talk to each other.

Closings can be delayed for weeks – sometimes months – because of missing documents, backlogs, or holidays. This is normal.

The fix:

-

Build extra time into your purchase schedule.

-

Use a local legal team that knows which offices move quickly – and which don’t.

-

Avoid scheduling tight international travel around your expected closing date.

#4. Rural Property Surprises

Properties in the countryside may come with hidden rules.

Agricultural land has different ownership laws, and you may be restricted in how you can use or develop it. Some regions have heritage protections or zoning limits that aren’t easy to change.

We’ve seen cases where buyers found out, too late, that their land couldn’t be used the way they planned – or that repairs required special permits from the regional heritage authority. That adds costs and delays.

The fix: Always do deep due diligence, especially for rural land or historic homes. Make sure your team checks:

-

Zoning and permitted use.

-

Agricultural protections.

-

Building and renovation restrictions.

-

Easements or access issues.

The Italian real estate system works – but it doesn’t work like what you’re used to in the US. Respecting the differences, slowing down when needed, and relying on qualified local professionals can save you a lot of money and stress in the long run.

Beyond the Purchase Price: What You’ll Actually Pay

Buying property in Italy isn’t just about the sale price – it’s also about the ongoing costs that come after you’ve closed.

Here’s what to expect in 2025:

One-Time Purchase Costs

#1. Registration Tax (Imposta di Registro)

This is a tax paid when the property is officially transferred to you:

- If the home will be your primary residence (and you’re an Italian resident), you’ll generally pay 2% of the cadastral value… unless you’re buying from a VAT-registered seller (like a developer). In that case, you’ll pay a VAT of either 10% or 22%, depending on whether the property is considered “luxury.”

- If you’re buying as an individual and the property is a second home or you’re not an Italian resident, you’ll typically pay a 9% registration tax on the cadastral value… unless you’re buying from a VAT-registered seller (again, like a developer). If so, then you’re back to paying VAT of either 10% or 22%, depending on whether the property is considered “luxury” or not.

- Purchasing through a company or trust can trigger different rules, especially around VAT, annual taxes, and certain disclosures.

Note: The cadastral value is not the market price—it’s a much lower “book value” assigned by the Italian Land Registry based on old assessment criteria. Taxes like the 2% or 9% registration tax are calculated on this lower value, not on the actual purchase price.

In some cases, minimum tax thresholds may apply—so even low-value properties may still trigger a baseline amount of tax.

Also, VAT (Value Added Tax) is a national sales tax charged on certain property purchases, typically when buying from a developer or VAT-registered seller.

#2. Mortgage and Cadastral Taxes

These are flat fees:

If you’re buying from a private seller: €50 each.

If buying from a registered company: €200 each.

#3. Notary Fees

Expect to pay 1–2% of the purchase price to the notary (notaio), who finalizes the deal.

#4. Real Estate Agent Commissions

Typically 4% to 10% of the total purchase price – often split between buyer and seller, but not always. The buyer’s side is usually 2% to 5%, although fees can vary widely based on region, custom, and what you’re able to negotiate.

Ongoing, Annual Costs

#1. Imposta Municipale Unica (IMU): Italy’s Property Tax

IMU is Italy’s annual municipal property tax. Here’s how it works:

If you live in Italy full-time and declare the home as your primary residence, you may be exempt.

If you’re not a resident (as most Americans are not), your home will be taxed as a “second home.” This is true even if you hold the property through a structure.

The IMU tax rate ranges between 0.86% and 1.06% of the cadastral value – often shown as 8.6‰ to 10.6‰.

So even if your home sits empty, you’ll still owe IMU each year – based on cadastral value, not market price.

#2. Tassa sui Rifiuti (TARI): Waste Collection Tax

This is a local tax to cover garbage and waste services. The cost depends on:

The size of the home (square meters).

How many people are registered as living there.

The city or town’s local rates.

On average, a family of four in an 80 m² home pays around €325 per year.

Key Tax Note for American Buyers

In most cases, you will owe IMU and TARI each year – even if the property is used only part-time. That’s because Italy does not offer primary residence tax exemptions to non-residents.

Also, don’t confuse cadastral value with what you paid for the home. Cadastral values are often much lower than market prices, but they’re still the basis for taxes. And they’re adjusted over time – not fixed.

It’s About Strategy, Not Sentiment

Buying property in Italy isn’t just about beauty, bargains, or even lifestyle. It’s about purpose – legal, financial, and strategic.

Italy offers real advantages: strong ownership rights, geographic diversification, and a piece of La Dolce Vita (even if you’re only interested in the 1-euro house program). But the path to success requires clear eyes, good partners, and a plan built on facts, not fantasy.

To approach Italian property like a professional – not a tourist – feel free to get in touch. We’ll help you figure out how Italian property can be a powerful piece of your family’s global strategy.

Sources:

-

Global Property Guide. (n.d.). Italy house prices, property market 2024: Real estate price history. GlobalPropertyGuide.com. Retrieved June 27, 2025, from https://www.globalpropertyguide.com/europe/italy/price-history

-

Agency for Digital Italy. (2023, October 3). Public administration digitalization: More than 30 interventions implemented by AgID as part of the “Italy Login – The citizen’s home” project. AgID.gov.it. https://www.agid.gov.it/en/agenzia/stampa-e-comunicazione/notizie/2023/10/03/public-administration-digitalization-more-30-interventions-implemented-agid-part

-

Eunews. (2025, February 26). Digital public services, Italy’s usage at 55 percent: Among the lowest in the EU. Eunews.it. https://www.eunews.it/en/2025/02/26/digital-public-services-italys-usage-at-55-percent-among-the-lowest-in-the-eu/

-

Interoperable Europe. (2023, December 21). Italy’s public service digital strategy updated. European Commission – Interoperable Europe. https://interoperable-europe.ec.europa.eu/collection/open-source-observatory-osor/news/italys-public-service-digital-strategy-updated

About The Author

We have 40+ years experience helping Americans move, live and invest internationally…

Need Help?

We have 40+ years experience helping Americans move, live and invest internationally…