What Larry King and Prince Had in Common

Former legendary talk show host Larry King died in January 2021 at the age of 87.

At first glance, he might not appear to have much in common with pop star Prince, who died in 2016 – beyond both celebrities being household names and both having passed away in recent years.

But Larry King and Prince do share one other important attribute: they both died without nailing down a clear division of their assets to their beneficiaries.

Free Wealth Protection Insights

Enter your email below to receive our weekly briefings on better ways to preserve your wealth, legally reduce your tax bill, and better protect what you’ve worked hard to build.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

PLEASE NOTE: This e-series will be delivered to you via email. You should receive your first message minutes after joining us. By signing up for this course, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

Prince’s Estate

Prince died without making a will or trust at all.

In his home state of Minnesota, as with most others, complex rules determine who gets what if someone dies intestate (without a will).

Prince’s parents and grandparents are dead, as are two of his half-siblings. He was married and divorced twice and had one son, but that child died shortly after birth. So Prince’s estate will be divided between his sister Tyka and his living half-siblings.

That’s just the beginning of the saga. To complicate matters further, Tyka and one half-brother, Albert, signed over part of their respective rights to the estate to Primary Wave, a music publishing company, in exchange for cash up-front as court proceedings dragged on. But only a few hours after signing the agreement with Primary Wave, Albert died, complicating things even more.

Now the IRS has stepped in. Last month, the agency accused Comerica Bank, which is serving as the executor of Prince’s estate, of undervaluing the estate by 50%, or about $80 million. The IRS is demanding another $32.4 million in estate tax, including a $6.4 million accuracy-related penalty.

In the meantime, the surviving heirs are becoming increasingly desperate, having spent well over $10 million in legal fees so far, with no end in sight.

Larry King’s Estate

And now, there’s every indication Larry King’s family will face a similar ordeal, although for different reasons.

King was married seven times and at the time of his death was in the final phase of divorce proceedings with his latest wife, Shawn King.

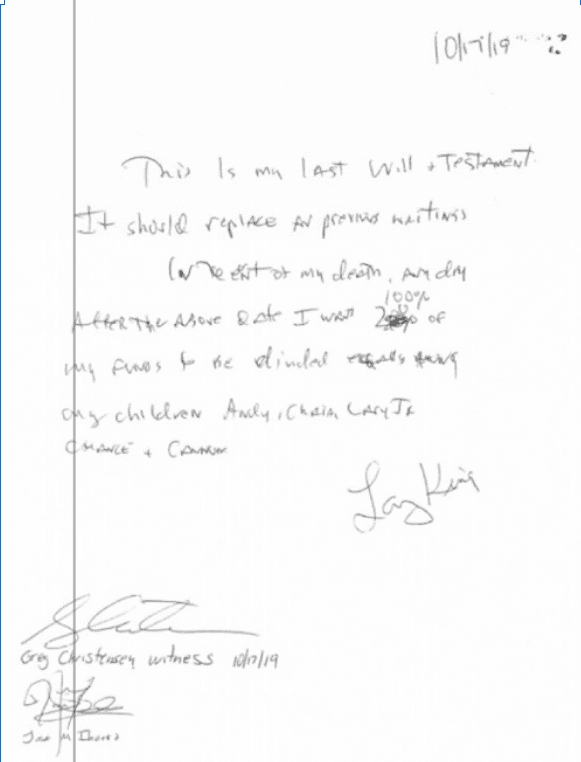

Larry and Shawn filed for divorce in August 2019. Only two months later, Larry prepared a secret handwritten will dividing his personal assets equally among his five children, and disinheriting Shawn entirely.

Here’s a screenshot of King’s will:

It gets even more interesting now, because two of the five children named in the will have since died.

King was better prepared than Prince, because only about $2 million of his estimated $144 million estate is subject to division under the will. The remainder of it is held in trusts that don’t currently appear to be at issue.

Nonetheless, $2 million is still a lot of money. Shawn thinks she should get it, but King’s son Larry, Jr. believes the money should be divided among the three remaining children. And naturally, they plan to fight it out in a California probate court – a very public setting. The proceedings will undoubtedly be attended by reporters and paparazzi, all seeking revealing or embarrassing content or photos to publish.

We have no idea who will win the contest. But one thing is certain: when it’s over, whoever gets the money will inherit a lot less than that $2 million once all the legal and court fees are paid.

Importance of Estate Planning: “Lessons Learned”

Since 1984, we’ve been involved with wealth preservation. And we’ve encountered a recurring belief in immortality among many clients. They don’t literally believe that they could live forever, though they often act as if they will.

The Costly Consequences of Aretha Franklin’s Incomplete Estate Plan

Aretha Franklin’s estate battle highlights the importance of thorough estate planning.

This cautionary tale shows how lack of a coherent plan can lead to costly legal disputes, unnecessary taxes, and loss of control over one’s legacy.

You can read more here: Aretha Franklin Estate.

Essential Tools for Estate Planning

That’s why we recommend to our clients that no matter how much wealth they possess, they prepare four basic estate planning documents:

- A living will, which describes the type of care you desire if you become permanently incapacitated or terminally ill. For instance, it will address the circumstances under which you wish to receive treatment possibly prolonging your life.

- A durable power of attorney for health care, which is a formal appointment of someone you trust to be your health care agent. This person will make the necessary care decisions for you if you are unable to do so. (A living will and durable power of attorney for health care are ordinarily combined in one set of instructions, called an advance directive.)

- A durable financial power of attorney, which assigns someone you trust the authority to act in your place. It comes into effect if you ever become physically and/or mentally incapacitated. Once it does, the person you name in this capacity will be acting in a manner legally equivalent to guardianship. They will take care of important matters for you – paying bills, managing investments, etc.

- A “regular” will, which memorializes your instructions for the division of your wealth among those you care about. The individual or company you name in your will as your executor, or “personal representative” in some states, must present your will to probate court. A judge will then authorize the executor to gather your assets and distribute them to your beneficiaries after any debts are paid.

Another document we recommend to all of our clients is a living trust. The biggest benefit is that the assets in a living trust, or that are controlled under its provisions, need not go through probate.

Top Estate Planning Tools for Asset Protection

Estate Planning and Asset Protection often go together. But what tools make for the best planning? You’ll find out here… with pros and cons for each: estate planning asset protection.

Need Help?

Since 1984, we’ve helped more than 15,000 customers and clients protect their wealth using proven, low-risk planning.

If you’d like to see if The Nestmann Group can help you develop a bespoke plan that meets your needs, the first step is to book in an introductory consultation with one of our Associates. Feel free to do so here.

What Gene Hackman’s Estate Battle Taught Us About Wealth Protection

Learn how Hollywood legend Gene Hackman’s $80 million estate battle

reveals critical wealth protection strategies everyone needs, regardless of net worth. Read more here: Gene Hackman estate.