My First Encounter with Government Deception

Do you remember the first time you realized that the government was lying to you?

For me, it happened in 1971, when I was 15. A Department of Defense employee named Daniel Ellsberg leaked a top-secret study of the US political and military involvement in Vietnam to The New York Times. The “Pentagon Papers” demonstrated that President Lyndon Johnson had “systematically lied, not only to the public but also to Congress.”

The big lie was that the justification for sending more than 2.7 million Americans to Vietnam (where more than 58,000 died) was to ensure an “independent, non-Communist South Vietnam.” But the real reason was “not to help a friend, but to contain China.”

Free Wealth Protection Insights

Enter your email below to receive our weekly briefings on better ways to preserve your wealth, legally reduce your tax bill, and better protect what you’ve worked hard to build.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

PLEASE NOTE: This e-series will be delivered to you via email. You should receive your first message minutes after joining us. By signing up for this course, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

Even at just 15, I was struck by the betrayal. Couldn’t the American people be trusted with the truth? Clearly, President Johnson didn’t think so.

Ellsberg, for revealing the truth, faced potential criminal charges that could have landed him in prison for 115 years. But the charges were eventually dropped when it was revealed that the government had illegally gathered evidence against him. This included breaking into his psychiatrist’s office.

The Government Is Lying to You About Inflation Manipulation

Since then, I’ve become better at detecting government lies. Some, like the Bush administration’s claim that Saddam Hussein possessed weapons of mass destruction, are easier to spot. Others, like the government’s inflation manipulation, are more subtle—but just as damaging.

How the Consumer Price Index is Manipulated

The Consumer Price Index (CPI), published monthly by the Bureau of Labor Statistics (BLS), is a prime example of subtle inflation manipulation by the government. The agency defines the CPI as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.”

In 2019, the CPI officially rose by 2.3%, following a 1.9% increase in 2018. But have you noticed that the prices you’re paying for food, healthcare, and insurance are increasing much faster than that? I certainly have.

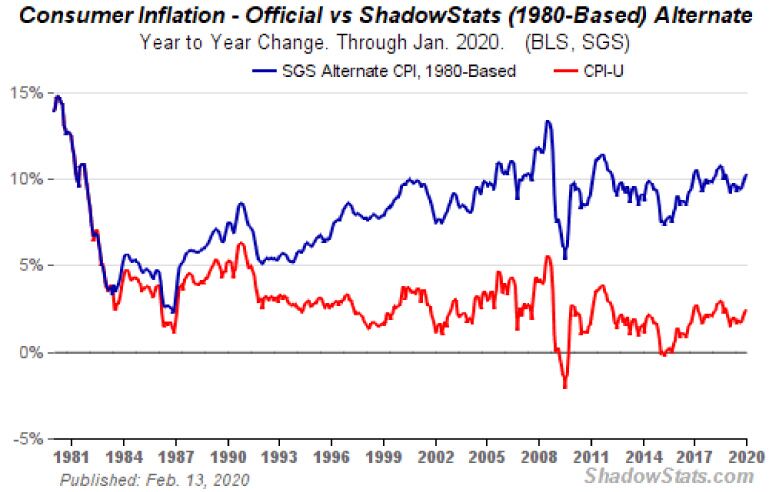

I’ve also rediscovered the work of economist John Williams and his superb website Shadowstats.com. It turns out that since 1980, the government has redefined how CPI is measured multiple times. According to Williams, if the CPI were still calculated the same way it was 40 years ago, the real inflation rate would be closer to 10%, not 2%.

Here’s a chart from his website. If inflation were calculated as it was in 1980, we’d see severe and ongoing inflation—around 10% instead of 2%.

Admittedly, most economists don’t agree with Williams. In fact, some argue that inflation is too low, and that the Federal Reserve should lower interest rates to spur more inflation. In late April 2020, the Fed did just that: a 0.5% interest rate cut to help the economy adjust to the coronavirus pandemic.

But in the real world, inflation is something we all feel. From the 1700s until around 1980, inflation was measured by tracking the price changes in a fixed basket of goods and services. But that’s no longer the case.

Starting in the 1980s, the BLS began changing how it calculates CPI. Now, instead of tracking a fixed basket of goods, it allows for substitutions—where consumers can swap out expensive items for cheaper alternatives. In the words of former Fed Chairman Alan Greenspan: “You’ll switch to something cheaper—more hamburger will show up in your meals than steak.” This manipulation makes it seem like the cost of living is rising more slowly than it really is.

Hedonic Adjustments: A Trick to Hide the Real Costs

But there’s more. The BLS also introduced the concept of hedonic adjustment. It assumes that as the quality of products improves, their effective cost decreases—even if you’re paying more. Imagine you’re buying a new car loaded with features, but it’s still more expensive than the same model from a decade ago. According to hedonic adjustments, the real price of the car is considered lower because of the improved features, even though you’ve paid more.

This trick explains why, according to the CPI, the price of a vehicle has barely increased in the last decade, even though the actual price tag has gone up by 30%. Just try buying the same car today for what you paid 10 years ago—you can’t.

The Consequences of Ignoring Real Inflation

These adjustments serve a political purpose. They allow Washington to dodge politically painful decisions like cutting Social Security or Medicare. In fact, Williams calculates that Social Security payments would be twice as large if the CPI hadn’t been adjusted over the past few decades.

It’s the same calculation Lyndon Johnson made in the 1960s: The American people can’t be trusted with the truth.

The long-term consequences of these lies are severe. Each year, the real value of your money declines by about 10%, not the 2% claimed by official figures. This means everyone in the U.S. must increase their income by at least 10% annually just to maintain their standard of living.

And that’s before taxes. If you’re paying 40% of your income in taxes, you’d need to increase your earnings by nearly 17% annually just to break even with real inflation.

No business can afford to raise prices by 17% every year and keep customers. And no conventional investment can offer a return of 17% consistently.

How You Can Protect Yourself

So, we know there is government inflation manipulation. But what can you do? One suggestion is to invest in real assets, especially gold, which tends to retain value during times of inflation. If you don’t have savings, your goal should be to increase your income and start accumulating real assets as soon as possible.

The US national debt is, as of this writing, approaching $23 trillion, with at least $200 trillion in unfunded obligations. There’s no way these obligations can ever be paid off. Lying about inflation delays the inevitable, but it can’t postpone the reckoning forever.

When it comes, it might begin with a deflationary spiral, at least in the official numbers. The Federal Reserve will attempt to counter this by sacrificing the dollar. They could even introduce negative interest rates as low as -5% or lower. This could lead to a dollar collapse, sparking hyperinflation and a depression worse than anything we’ve seen.

The clock is ticking. Every day you wait, the real value of your savings slips further. If you’re serious about protecting your financial future, it’s time to act now. Don’t wait until inflation destroys the wealth you’ve worked so hard to build.”

Need Help?

Since 1984, we’ve helped more than 15,000 customers and clients protect their wealth using proven, low-risk domestic and offshore planning. To see if our planning is right for you, please book an introductory consultation with one of our Associates. You can do that here.