Investing in Overseas Property for Americans Afraid of US Market Chaos

-

Written by The Nestmann Group

- Reviewed by Brandon Roe

-

Updated: June 17, 2025

Contents

- Why Consider Investing in Overseas Property Now?

- The Reporting Advantage of Offshore Real Estate

- Who Is This Strategy Best For?

- Property Type Options for Offshore Real Estate Investors

- 1. Bare Land

- 2. Fixer-Uppers

- 3. Pre-Construction Properties

- 4. Apartments and Condos

- 5. Short-Term Rentals

- Financing Differences to Consider for Offshore Real Estate

- Top Markets for Offshore Real Estate Investment

- #1:Panama

- #2: Portugal

- #3: Mexico

- Practical Use Cases

- Tax Implications for Americans Investing in Overseas Property

- Key Tips for Successful Foreign Property Investment

- Additional Benefits of Foreign Property

- Conclusion

How to insulate against US market chaos with foreign property—legally.

It’s been building up for some years, but since early 2025, we’ve seen a surge in the number of Americans looking to get out of the US dollar and the chaos of the US markets. For many, the solution is overseas property.

That’s because investing in foreign property is a proven way to diversify your portfolio. It’s a useful hedge against US dollar risk. And it can even help you get a second residency and second citizenship.

Planning to Buy Property Abroad? Start Here.

Before you sign anything overseas, make sure you know what you’re doing.

Our most popular expert resources – on structuring, taxation, legal pitfalls, and due diligence – are yours, free.

The Nestmann Group does not sell, rent or otherwise share your private details with third parties. Learn more about our privacy policy here.

By signing up for this briefing, you’ll also start to receive our popular weekly publication, Nestmann’s Notes. If you don’t want to receive that, simply email or click the unsubscribe link found in every message.

Plus, you don’t need to be a multi-millionaire to get started.

And while you won’t find 30-year fixed mortgages in most other countries like you would in the US, options like empty land, fixer-uppers, pre-construction deals, and vacation rentals in places like Panama, Portugal, and Mexico can still provide steady returns.

(In fact, we routinely work with clients who have seen five- and six-figure gains on apartments and condos they purchased just a few years ago.)

In this article, we’ll explain the simplest way to invest in overseas property – legally and strategically – while making a good income, keeping your options open for retirement, and having a “Plan B” outside the US.

Why Consider Investing in Overseas Property Now?

Investing in overseas property has grown in popularity for Americans worried about what’s happening at home.

Before COVID-19, Americans had other ways to invest internationally. In fact, when interest rates were basically nothing, you could get a foreign CD in US dollars that rivaled the returns of US treasuries a few years ago. Those options still exist but they aren’t as attractive given the current chaos of the global financial system. Foreign real estate can help insulate you from this chaos.

For those who are tired of US market roller coasters, offshore real estate still offers a great alternative. When you set it up right, investing in overseas property lets you move your money outside the US into something that grows steadily without crazy swings.

Here’s why many Americans are nervous right now:

- Rising prices eating away at the value of dollar-based investments.

- Stock market swings caused by various economic and political factors, including the threat of tariffs.

- Growing national debt raising questions about the dollar’s future.

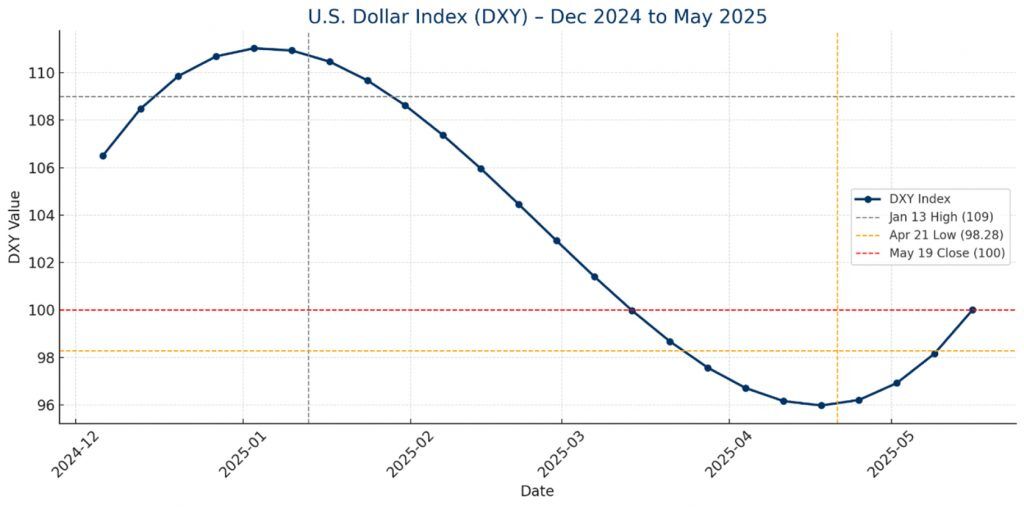

Not to mention a weakening US dollar: since the Fed announced its most recent rate cut in December 2024, the US Dollar Index (DXY) shows an overall decline after a brief peak relative to a basket of other major currencies, including the Euro and Swiss Franc:

Source: MarketWatch (6M chart)

In this environment, having some of your money in foreign real estate through offshore property investment gives you practical protection, peace of mind, and a useful first step toward international investing.

The Reporting Advantage of Offshore Real Estate

A notable perk of investing in overseas property is that you don’t have to tell the IRS about it in most cases. According to the IRS, foreign real estate held in your personal name doesn’t need to be reported on forms like FBAR (Foreign Bank Account Report—FinCEN Form 114) or Form 8938 (FATCA—Foreign Account Tax Compliance Act).

This differs from foreign bank accounts, which you must report if their amounts exceed $10,000 at any point during the calendar year – even for a brief moment.

But here’s an important catch: if you hold the property through a foreign company like an LLC (say, an SRL in Panama, for instance), you would need to report the company itself. This creates an indirect reporting requirement for the property.

Own Assets Abroad? Here’s What the IRS Actually Cares About

Not all offshore assets trigger reporting requirements. But a lot do – and not always for the reasons you’d expect.

The challenge isn’t just about staying compliant. It’s about avoiding unnecessary paperwork. Keeping your privacy. And understanding how to structure things the right way, the first time.

Our complete Offshore Asset Reporting Guide, available through the Nestmann Inner Circle, covers:

-

Which foreign assets trigger IRS disclosure – and which don’t.

-

How to hold overseas real estate without unnecessary reporting headaches.

-

Common mistakes that attract scrutiny (and how our clients avoid them).

-

Legal strategies for privacy, compliance, and peace of mind.

Who Is This Strategy Best For?

Offshore real estate and investing in overseas property isn’t for everyone. You’ll need:

- Anywhere between $200,000 and $300,000 or more in money you can invest.

- Although quick wins are possible, best results will come from a medium to long-term plan.

- Willingness to navigate foreign property markets with the help of qualified experts.

The ideal person for investing in overseas property and offshore real estate is someone looking for:

- Investment income outside the US dollar.

- A potential place to retire.

- A “Plan B” escape hatch if US conditions get worse.

It’s worth mentioning that there are three key steps to keep in mind for Americans looking to do this the right way, the first time. You’ll need to:

- Understand the language your contract is written in.

- Make sure foreign real estate makes sense in your overall wealth protection plan.

- Understand how to keep everything US compliant.

We’ve been helping Americans purchase foreign real estate since 1984. A few popular locations that interest our clients include Portugal, Mexico, Costa Rica, and Panama.

For help with planning your next (or first) offshore real estate investment, feel free to get in touch.

Property Type Options for Offshore Real Estate Investors

When investing in overseas property, Americans have several types of properties to choose from:

1. Bare Land

Buying undeveloped land can be a cheaper way to get started with potential for big gains. The strategy with offshore property investment is to buy in growing areas that will develop more in the coming years, then either:

- Hold it and wait for it to increase in value.

- Build on it when you’re ready.

- Sell it to developers once prices go up.

Land usually has low carrying costs and needs little maintenance, making it easier to manage than other investments. This works especially well in countries where tourism is growing and new infrastructure is being built.

For example, a client of ours recently purchased real estate in a rural area of Uruguay as a long-term hold, but he’s already seeing appreciation as the nearby suburbs start to expand.

The trick is finding areas with strong future potential before major roads, utilities, or other projects are completed and prices jump.

2. Fixer-Uppers

Following what’s popular in places like Italy, where you can buy old properties for low prices, getting a property that needs work offers both a project and an investment opportunity when investing in overseas property.

This approach needs:

- More hands-on management.

- Extra money for renovations.

- Local contractors and an understanding of building rules.

The upside is that you can greatly increase the value after making improvements. Many European countries, including Portugal, have older properties in rural areas that you can buy reasonably and turn into vacation homes or rental properties for your offshore real estate portfolio.

Labor costs vary widely depending on the country.

3. Pre-Construction Properties

When investing in overseas property, buying during the building phase before completion often lets you:

- Get lower prices than finished properties.

- Make payments in stages during construction.

- Customize some parts of the property.

This option comes with the risk that the developer might have problems, but often provides big value increases by the time it’s finished, when looking for offshore real estate investments.

Many offshore places keep your financial affairs more private than the US. While certain details of US trusts may become public during lawsuits, foreign trusts usually stay private.

One of the biggest risks here is a delay in the project. For example, a well-connected resource in Playa del Carmen – a very popular place for American expats – recently told us that about 40% of developers were behind schedule.

Like many construction projects, it pays to assume some delays.

4. Apartments and Condos

Ready-to-rent apartments and condos in areas popular with expats offer the quickest way to start making income through offshore real estate. These properties:

- Usually come with management services already available.

- Require less maintenance than single-family homes.

- Often have amenities that renters and vacationers want.

Of course, you’re not likely to experience “quick wins” as with other options.

5. Short-Term Rentals

- Use the property yourself when you want to.

- Make money during times you’re not there.

- Potentially cover your ownership costs with rental income.

Financing Differences to Consider for Offshore Real Estate

One big difference between the US and foreign property markets is how financing works. Americans used to 30-year fixed rate mortgages will find that these rarely exist outside the US when investing in overseas property.

Instead, foreign mortgages for offshore real estate typically have:

- 5 or 10-year interest rate terms instead of a single rate locked in over 30.

- Interest rates that change periodically rather than staying fixed.

- Higher down payments required (often 30-40%).

- Shorter payoff periods.

Many American buyers end up paying cash for foreign properties or getting financing through US-based assets instead of through foreign lenders when investing in overseas property and offshore real estate markets.

Top Markets for Offshore Real Estate Investment

Based on what our American clients prefer, three markets stand out for offshore real estate:

#1: Panama

Panama uses the US dollar, which eliminates currency risk, and has strong property rights and a stable government for offshore property investment – but buying real estate in Panama still serves as an effective hedge against US dollar risk

Why is that? Because your investment is tied to the local real estate market, not the US dollar. So — if the US dollar weakens — the value of your foreign property may actually increase in relative terms, helping protect your wealth from a decline in purchasing power.

Key areas for investing in overseas property and offshore real estate include:

- Panama City for city apartments.

- Coronado and nearby beach areas for vacation rentals.

- Boquete for mountain retirement.

Of course, different strokes for different folks. Some of our clients prefer Coronado for the simplicity of beach life – others prefer Boquete for a quiet lifestyle that’s completely unrelated to retirement or anything foreign real estate-related.

According to Global Property Guide, home sales continue to strongly rise in Panama, fueled by the growing presence of international buyers in the market.

#2: Portugal

Portugal has become very popular with Americans seeking European residency through offshore property investment and offshore real estate. The country offers:

- A lower cost of living than most Western European countries.

- Good healthcare and quality of life.

- Established communities of expats.

Median dwelling prices in Portugal have been consistently rising in recent years. Rental yields remain moderately good, usually between 3.5% and 7.6%.

A US buyer-turned-Nestmann-client was previously advised by a Portuguese lawyer to set up a foreign structure without considering US tax implications – potentially triggering Controlled Foreign Corporation (CFC) compliance and double taxation.

Doing things right the first time is essential, but so is steering clear of bad advice.

#3: Mexico

Mexico’s proximity to the US makes it an evergreen favorite for American investors looking at investing in overseas property. Foreign buyers and an expanding Mexican middle class drive the nation’s real estate market growth.

Popular markets for offshore property investment include:

- Playa del Carmen and Tulum for vacation rentals.

- Puerto Vallarta for long-term expat housing.

- San Miguel de Allende for cultural and retirement living.

Mexico’s housing market remains resilient, propped up by sustained demand and new construction. In the fourth quarter of 2024, the Federal Mortgage Society (SHF) reported an 8.7% year-on-year increase in the House Price Index for homes bought with a mortgage, compared to the same period in 2023.

Practical Use Cases

The most common strategy we’re seeing clients implement for investing in overseas property is the hybrid personal-use/rental model:

- Purchase a property in a desirable location.

- List it on short-term rental platforms like Airbnb or VRBO.

- Block off personal-use dates during preferred seasons.

- Maximize rental income during peak tourism periods.

This approach to offshore property investment lets owners:

- Generate income when they’re not using the property.

- Have a ready-made vacation home when desired.

- Test-drive a potential retirement location.

- Establish an offshore presence without complex structures.

Before You Buy Overseas Property

Avoid costly mistakes in international real estate. Learn the 8 key pitfalls and how to navigate them successfully here: pitfalls of international real estate.

Tax Implications for Americans Investing in Overseas Property

While the property itself may not need to be reported, any income it generates must be declared on your US tax return, regardless of where it’s earned. This is an important consideration for offshore real estate investors.

Rental Income Reporting

You’ll use the same basic rules for holding foreign property individually as you would for properties in the US, reporting this income on Schedule E of your tax return.

In certain situations, using a structure — like a trust or LLC — to hold your foreign property can be smart. It’s particularly useful for avoiding probate and asset protection.

Key things to remember when investing in overseas property and offshore real estate:

You must report all rental income in US dollars.

You can deduct the same expenses as with US properties, including:

Mortgage interest.

Property management fees.

Repairs and maintenance.

Travel expenses for property management.

Local property taxes.

- When figuring depreciation for foreign properties, you use a 30-year schedule (instead of 27.5 years for US properties)

Foreign Tax Credits

If you pay taxes on your rental income in the country where the property is located, you can usually claim those as foreign tax credits on your US return when investing in overseas property and offshore real estate. This helps you avoid being taxed twice on the same income.

You can either deduct foreign rental property taxes as an expense or use them as a foreign tax credit to reduce your US tax liability, depending on which option provides greater savings in your situation.

Bank Account Reporting

While the offshore real estate property itself doesn’t trigger reporting, any foreign bank accounts you use to manage the property may. FBAR reporting becomes mandatory if your foreign account’s total balance reaches $10,000 at any point in time during the calendar year, no matter how brief.

Short-Term Rental Considerations for Offshore Real Estate

If you plan to use platforms like Airbnb or VRBO for short-term rentals when investing in overseas property, there are extra tax things to know. For instance, there’s a helpful “14-day rule” to be aware of: If you rent out your property for 14 days or fewer during the year, you’re generally not required to report the rental income on your taxes. (The “Augusta” rule.)

This could be a great advantage for properties you mainly use yourself but occasionally rent out. However, if you’re making significant rental income through offshore property investment, you’ll need to carefully track when you use the property yourself versus when it’s rented to ensure proper tax treatment.

Capital Gains When Selling Offshore Real Estate

If you eventually sell your foreign property, you’ll need to pay US capital gains tax on any profit. Under IRS Section 121, you can leverage a $250,000 exclusion on capital gains tax for the sale of your primary residence, or up to $500,000 for married couples filing jointly, provided you meet specific criteria.

To qualify for this exclusion when investing in overseas property, you need to have owned the home and used it as your primary residence for at least two of the five years preceding the sale.

This makes offshore property investment particularly attractive for those planning to eventually retire overseas or split their time between multiple residences.

Key Tips for Successful Foreign Property Investment

1. Understand the Language of Your Contract

When investing in overseas property, always ensure you understand the contract language or have professional translation services for all documents.

Legal terms can have very different meanings across jurisdictions, and misunderstandings can lead to serious complications in offshore real estate transactions.

We review a lot of dual language contracts for clients. Most of the time, if the English translation conflicts with the original language, the original language will be considered to be the correct version.

That makes it very important to understand the original even if there’s an English version there.

2. Align with Your Overall Plan

Offshore property investment should fit into your broader financial and lifestyle goals. Are you buying primarily for:

- Current income generation?

- Future retirement use?

- Capital appreciation?

- A combination of purposes?

Make sure the property and location align with your primary objective.

3. Ensure US Tax Compliance

We partner with expert international tax professionals to, ensuring our clients’ foreign real estate income and gains are compliant with US tax law. This includes:

- Proper rental income reporting.

- Claiming appropriate deductions.

- Managing potential foreign tax credits.

- Structuring ownership optimally.

4. Consider Local Property Management

Unless you plan to live in your investment property yourself, professional management is essential for rental properties when investing in overseas property. Research management companies that:

- Have experience working with foreign owners.

- Maintain transparent reporting systems.

- Understand both local rental markets and international guest expectations.

- Can handle maintenance issues promptly.

5. Understand Currency Implications

When investing in overseas property across currencies, you need to consider:

- Exchange rate fluctuations affecting your returns when converted to dollars.

- Transfer costs for moving money internationally.

- Local banking relationships to manage rental income.

In dollarized economies like Panama, this risk is minimized, but in countries with their own currencies, exchange rates can significantly impact your real returns from offshore property investment.

6. Research Local Ownership Rules

Some countries have restrictions on foreign ownership for offshore real estate, particularly for beachfront property or agricultural land. For example:

- Mexico requires foreigners to purchase coastal property through a fideicomiso (bank trust).

- In Thailand, while foreigners are allowed to own condominiums directly, they cannot own land outright.

- In Dubai, foreigners can only own properties outright in specified “freehold” zones.

- Certain types of historical properties may have renovation restrictions.

Understanding these rules before purchase prevents expensive surprises later when investing in overseas property.

Additional Benefits of Foreign Property

Beyond the financial aspects already discussed, foreign real estate ownership offers several additional advantages:

Expanded Personal Network

Owning property in another country naturally expands your international connections. You’ll develop relationships with local professionals, neighbors, and potentially other expat property owners—connections that can lead to new opportunities and insights.

Cultural Experience

Regular visits to your foreign property allow you to experience the local culture in ways that typical tourism cannot. This cultural connection can become a valuable aspect of your investment.

Physical Asset Control

In an increasingly digital world where many investments exist only as numbers on a screen, physical real estate provides tangible control. You can see, touch, and personally improve your investment—something many find satisfying compared to abstract financial instruments.

Conclusion

For Americans with enough capital who want protection from US market volatility, foreign real estate offers a compelling combination of benefits: potential appreciation, rental income, personal enjoyment, and minimal reporting requirements when properly structured.

While traditional US leverage strategies like 30-year fixed mortgages may not be available, the trade-offs – including privacy, diversification, and sometimes higher yields – make offshore property an attractive option for those looking to reduce US dollar exposure and establish a physical presence abroad.

Whether you’re preparing for retirement, creating a “Plan B,” or simply diversifying your investment portfolio, personally-held foreign real estate deserves consideration as part of your wealth protection strategy.

To explore whether this approach is right for your specific situation, request a consultation with a Nestmann Associate who can guide you through the process of finding, buying, and managing foreign property as part of your overall financial plan.

About The Author

We have 40+ years experience helping Americans move, live and invest internationally…

Need Help?

We have 40+ years experience helping Americans move, live and invest internationally…