Wealth Protection Planning for More than Four Decades

Since 1984, we’ve offered wealth protection strategies and services to more than 15,000 American customers and clients.

Here’s how we can help you too…

How do we help you protect your wealth?

What building blocks we use depends on where you are in life, what you hope to achieve, your risk profile, and any circumstances that can affect planning recommendations one way or the other.

State and Federal Government Protections

Domestic and International Insurance

Bank Safety Issues

Retirement Planning

Wealth Management

Tax Reduction Opportunities

Anti-Inflation Strategies

Asset Protection for Traditional and Alternative Assets

Personal Freedom through Second Residencies and Second Passports

What does our work look like in practice?

Sometimes people have a hard time understanding exactly what we do. After all, “international wealth protection planning” can mean different things to different people. So here’s a sample of actual work we’re doing for clients right now.

Two levels of service

Do It Yourself (DIY)

For simpler cases, we can help show you how to create effective plans that protect your wealth but don’t cost a lot.

Full Service Wealth Protection

For high-net-worth individuals and families, entrepreneurs and expats with complicated filings, we offer full-service wealth protection planning.

What makes our wealth protection services different?

Most advisors specialize in one or two areas and try to fit their clients into that solution. That might be good for the provider. But if it’s not the right fit for you, you aren’t going to get the wealth protection you’re looking for.

We don’t specialize in one or two areas. Instead, we are generalists that can see the whole picture and then work with the specialists to put your plan into action.

Most advisors stick with what’s available to them in the US. We see a whole big world out there full of wealth protection opportunities for the right clients.

This approach – of combining domestic and international strategies for maximum wealth protection and freedom – has truly set us apart since 1984.

Who are our Wealth Protection Clients?

We work with a wide range of clients – from solo entrepreneurs to other advisors in related areas. But our core clients fit into one or more of the following groups:

High Net Worth Families and Individuals

This group has at least $2,500,000 and/or a pre-tax annual income of $400,000. They tend to have a wide range of assets – both traditional and alternative… and have access to opportunities not available to the general public.

Because of their wealth, frivolous lawsuits can be a problem. Estate planning is usually more complex. Specialized asset protection may be necessary. And there are often tax reduction opportunities.

Retirees

Retirees are often focused on wealth preservation. They usually have a nestegg but not a lot of income, so keeping what they have is very important.

When we work with such clients, we put a heavy focus on eliminating risk from their lives. Anti-inflation strategies, making full use of government protections, and specialized insurance play their part.

Depending on how far the client is into retirement, pensions and estate planning often need to be considered.

Business Owners

We work with many business owners who are asset-rich but cash-poor. They often have a big chunk of their wealth tied up in their business and/or the building it’s in and/or the land it sits on.

With such clients, reducing risk plays a big necessity. But there’s a lot of opportunity too – business owners have the chance to reduce their tax burden in a way other groups don’t have.

Expatriates

Americans living overseas have some unique problems that those living stateside don’t have to deal with.

As it relates to wealth protection, the biggest is never-ending reporting to Uncle Sam on almost any asset held overseas – from bank accounts to stocks to foreign property not held in your own name.

When we work with such clients, we often have to focus a lot on compliance and reporting issues. But there are also some opportunities – most notably substantial tax breaks Americans living overseas can access that others can’t.

Professional Investors

Over the years, we’ve worked with quite a few professional investors.

They often fit into one or more of the other groups and have some of the same needs as other groups. But because they (usually) have their fingers in so many pies, risk management tends to be a focus for their planning.

It’s worth mentioning that, while net worth is a factor, wealth protection planning isn’t just about net worth. It’s important that everyone have a proper plan in place – whether your nest egg is $1 million or $100 million.

What will change is the tools available to you and the type of experts you’ll need to build it.

Nestmann Group Reviews

Over 40+ years, we’ve worked with thousands of customers and clients. Understandably, many are uncomfortable going “on record” about such a personal topic.

But here are some reviews about our services, with names changed to protect privacy.

I chose the Nestmann Group because they have a good track record with such programs and strong customer service. I’m very happy to recommend them.

Dale S.

Florida

I have been a client of the Nestmann Group for many years. Their service is professional, competent, and trustworthy.

John V.

Michigan

I chose the Nestmann Group because of their communication. I received a high level of professional service that got the job done.

Eric

South Africa

My consultation session with Brandon was fantastic. I’m very pleased with the suggestions I’ve since received from him, and I’m steadily working to take action on each bit of advice. I had reached a point where I felt I had too many juggling balls airborne, and I recognized I needed to seek quality guidance on how to best manage what I’d thrown into the air. I’m glad I was directed toward Brandon and Nestmann, and I hope my recommendation of their services will be beneficial to you too!

Paul Z.

Florida

It was so nice to work with a group of people with integrity when so many people these days are just trying to sell you something you don’t need.

Shared Anonymously

US Citizen living in Malaysia

I appreciated the quick turnaround time. I rarely had to wait long for an answer.

When you’re making this kind of an investment, you want someone who is attentive to your needs and they were.

Thomas M.

Florida

Brandon and Mark, and the whole organization, did a great job for me. They were expert and prompt.

I especially appreciated the fact that they so clearly put my interests first. I would highly recommend The Nestmann Group.

T. Bohmann

Texas

The Nestmann team offers a very high level of client services. We appreciate their quick and clear communication.

It gives us peace of mind to know they are on our team.

Posted Anonymously

By Request

I am truly grateful for the outstanding guidance and international expertise provided by Mark, Brandon and the entire team.

Most importantly, they are highly principled in their recommendations, always prioritizing my needs above all else.

R. H.

California

We couldn’t be happier with the services we are receiving from the Nestmann Group. Brandon and Brooke have been easy to work with and are happy to answer any number of questions and deal with issues we may confront. They have made arrangements with other professionals, in addition to their wise counsel, for dealing with many things, some mundane and others not.

Although we sought out their services after we had already obtained both a home and residency internationally, they are continuing to help us see things we oftentimes didn’t even consider as we approach retirement and permanent relocation to Spain. We look forward to continuing our work with them in the years to come.

Tony & Michael

Oregon

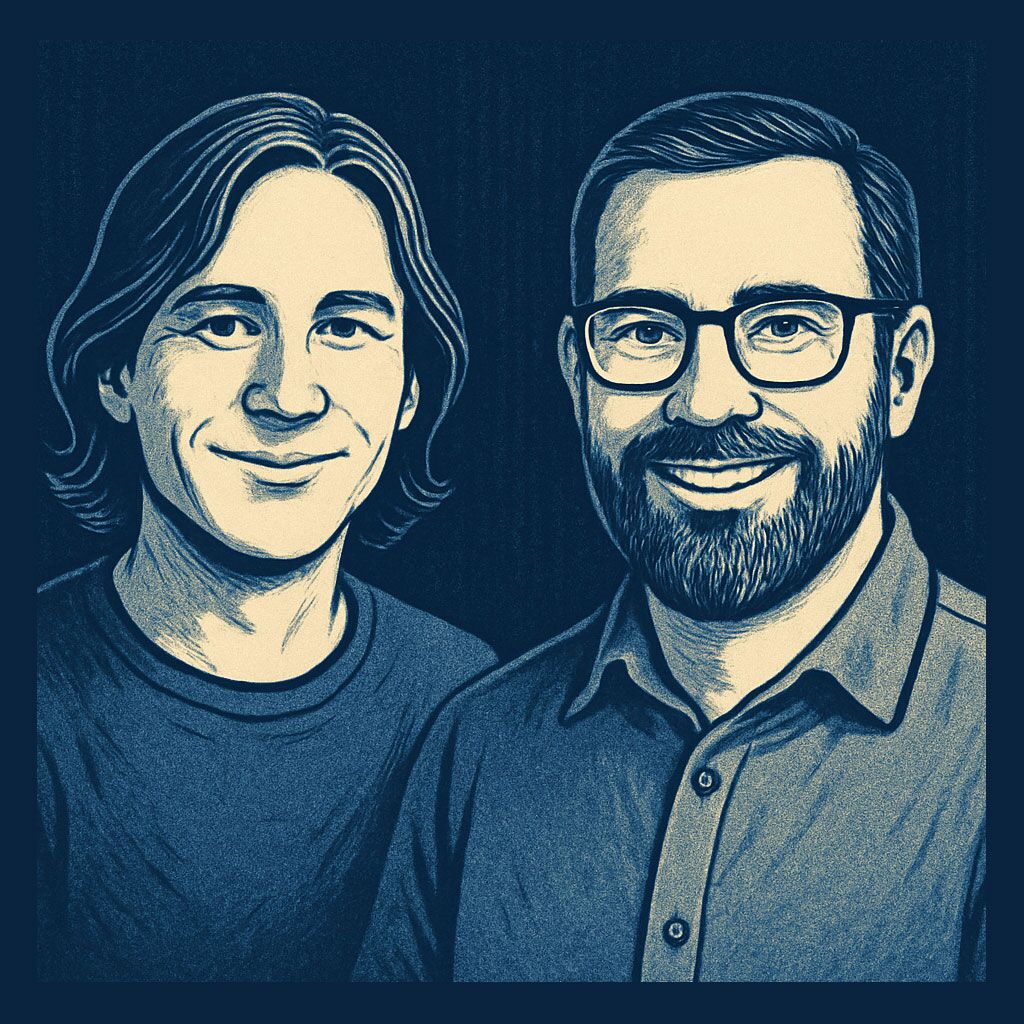

Note: Images shown with testimonials are for illustrative purposes only and do not depict the actual individuals, in order to protect their privacy.

Key People

Mark Nestmann

In 1984, Mark Nestmann founded what would become The Nestmann Group. He holds a Masters of Law (LL.M) in international tax law from the Vienna University of Economics and Business Administration.

Within the Nestmann Group, Mark contributes to our premium services including the Nestmann Inner Circle and the Nestmann Exchange. He also heads up private client planning through our Private Wealth service.

Brandon Roe

Paul Castillo

Paul joined our team in 2016 and since then, has personally helped hundreds of clients decide if our wealth protection services are right for them. In addition to being the main contact for prospective clients, Paul also hosts a number of our products including occasional open webinars and the Nestmann Exchange.

Notable Media Coverage

Our work has been featured in well-known media outlets including The Washington Post, Barron’s, ABC News, The New York Times, Bloomberg Businessweek and Forbes.

You may have also seen it appear in popular niche publications including The Harry Schultz Letter, The Daily Reckoning, International Living and Simon Black’s Sovereign Man Confidential. We have also regularly appeared on Jim Puplava’s Financial Sense Network, LewRockwell.com, The Oxford Club, The Sovereign Society / Banyan Hill and many others.

FAQ

What exactly do you do? Are you lawyers or legal advisors?

No, we’re not lawyers or legal advisors. We’re structured as a family office that specializes in helping US clients who hold international assets. Clients come to us for holistic planning solutions that generally go beyond what one specialist will do. In doing so, they’re saved from having to figure out all the moving pieces needed to make a typical scenario work.

Think of us as your architect, contractor, and property manager, depending on where you are in the international wealth planning process.

The best way we’ve found to explain it is as follows:

- In the planning phase, we act as the architect, identifying what needs to be built and organizing the right professionals.

- In implementation, we serve as the contractor, coordinating foreign legal, accounting, and tax partners to put your structure in place.

- During ongoing maintenance, we operate like a property manager, keeping your plan in good order and compliant year after year.

Do you specialize in any specific areas?

Although we will take on any engagement that involves US and international planning, many of our clients often have a need for the following:

- Foreign Real Estate: Building the most cost-effective structure that keeps taxes to a minimum, works within a US estate plan, and uses structures to avoid probate in the foreign country.

- Swiss Bank Accounts and Swiss Asset Management: We help you find the right bank and advisor. Then working with our partners, we help you set up and maintain your account.

- International Precious Metals: Buying, selling, moving, or storing international precious metals – personally or through offshore structures like foreign trusts or companies.

- Offshore Insurance: Tax-deferred and/or tax-exempt offshore insurance products that can hold foreign real estate, foreign bank accounts, foreign stocks and funds, or precious metals.

How are you different from a lawyer or CPA?

Most lawyers or CPAs focus on one jurisdiction and one specialty. We build and maintain cross-border plans, pulling together all the moving parts across multiple countries. That means we’re looking at your whole picture—your goals, assets, tax exposure, and legal risks.

Why would I work with you instead of my local lawyer?

There’s nothing wrong with working with your local lawyer or accountant. But after 40 years of doing this, we’ve noticed that not every lawyer has the perspective some clients need to properly protect their wealth.

If you are 100% sure you need a specific product, service or strategy your local lawyer can offer, then it’s a good idea to work with them.

But if you want a holistic view of wealth protection that takes every threat and opportunity into account – with no bias towards any one solution – then give The Nestmann Group a chance to have a look.

What kinds of clients do you typically work with?

Our clients are US citizens and permanent residents looking to protect their wealth, reduce taxes legally, and gain greater financial freedom. Many own international assets, run location-independent businesses, or plan to move abroad.

That includes:

- Business owners with offshore income or international operations.

- Investors building legally compliant offshore structures.

- Families interested in multigenerational wealth preservation.

Whether you’re just starting to internationalize or you’ve already taken steps abroad, we help coordinate the tax, legal, and compliance pieces into a cohesive strategy.

Do you only work with high-net-worth clients?

Not at all. While many of our clients are high-net-worth individuals, our planning is just as valuable for anyone serious about protecting their assets and planning across borders. What matters most is your long-term vision, not your balance sheet.

Do I need to move overseas to benefit from your services?

No. Many of our clients stay US-based but want to diversify internationally or strengthen their asset protection.

You don’t need to give up your citizenship or move overseas to benefit from our work. In fact, a growing number of clients are simply looking to add offshore components – like an international trust, second residency, or foreign bank account—to their existing structure as a hedge against future uncertainty.

Whether you stay put or go abroad, we make sure the strategy supports your goals and is compliant with US law.

What’s the difference between tax evasion and legal tax reduction?

Tax evasion is illegal—period. It means hiding income, failing to report accounts, or misleading the IRS. That’s not what we do.

What we do help with is legal tax reduction. That includes choosing favorable jurisdictions, structuring assets strategically, and making full use of what the law allows.

Our planning is 100% compliant, coordinated with trusted legal and tax professionals in both the US and abroad. A dedication to this principle has earned us a reputation in the industry as being very conservative, even “boring”.

There’s nothing unethical about reducing your tax burden—if you do it the right way. It just takes smart strategy, experienced guidance, and a long-term view.

I have a legal problem and need to protect my assets. Can you help?

As we are not currently licensed to practice law in any US state, we cannot offer legal help of any kind. We are a wealth protection planning service that helps US clients invest internationally.

You should know that, if someone does come after you, your window for planning is almost always closed anyway (thanks to something called “fraudulent transfer”). Wealth protection planning needs to be done BEFORE there’s a concrete threat, not after.

Can you help set up offshore trusts or LLCs for US citizens?

Yes. We focus on strategy and coordination. When your plan calls for a trust, company, or insurance policy, we can set it up for you.

Can you work with my existing legal or tax advisors?

Absolutely. We often collaborate with our clients’ current professionals to make sure your planning is cohesive and legally sound in every jurisdiction involved.

How credible is the Nestmann Group?

Mark Nestmann launched what would become The Nestmann Group in 1984. Since then, we’ve helped more than 15,000 customers and clients with their wealth protection needs.

On this page you’ll find a number of testimonials and reference letters from clients.

Not only have we been covered in numerous mainstream media, but leaders in wealth protection and international living world sing our praises too.

Of course, the best way is to review our free resources. That will give you a clear idea of the expertise we bring to the table.

Then, when ready, feel free to get in touch to see how best we can help you.

Where is The Nestmann Group based?

We’re headquartered in Arizona but operate virtually and work with clients across the United States and abroad. Our advisors and network of partners span multiple jurisdictions, allowing us to deliver international solutions no matter where you are located.

How do I get started working with you?

We offer a paid introductory consultation for clients ready to take the next step. It’s a focused session with one of our Wealth Protection Advisors where we assess your goals and review your current situation. We’ll help identify what’s working, what’s not, and what kind of structure would best meet your goals.

If there’s a good fit to work together longer term, we move into the planning phase. We also coordinate the implementation of your plan and remain available for long-term support and ongoing maintenance.

Need some Help?

For more than 40 years now, our team has helped American clients move abroad, invest internationally, and do business all over the world… in a way that preserves your privacy and protects your wealth.

In practice, we build plans to help you do that. And then connect you with the resources on-the-ground needed to turn your dream into reality.

Schedule a consultation with one of our Associates to get your questions answered and discover how we can help you achieve your goals.

Why build your Plan B with us?

Quite simply, because we have the most experience of any active globally-focused wealth protection firm serving US clients.

Since 1984, we’ve helped more than 15,000 customers and clients diversify their assets, protect their wealth, and invest internationally. In the process, they’ve been able to lower their tax burden, gain more freedom, and have a better life.

More than that, we walk the talk. We live the lifestyle. Our partners have lived, worked, and invested internationally.